All Posts by Roger Foisy

A Good Lawyer vs the Right Lawyer: How Do You Know If You Have Found the Right Lawyer?

Navigating the complexities of a legal case can be overwhelming, no matter what your situation may be. The heart of managing those complexities is the relationship between you and your lawyer, a partnership that can influence the outcome of your case.

Navigating the complexities of a legal case can be overwhelming, no matter what your situation may be. The heart of managing those complexities is the relationship between you and your lawyer, a partnership that can influence the outcome of your case.

But in a world with hundreds of good personal injury lawyers, how do you find the right lawyer? Are all good lawyers the right lawyers? How do you avoid the wrong lawyer?

At Foisy & Associates, we understand that the ideal legal representation goes beyond legal expertise; it involves a relationship built on trust, communication, and respect. Follow these suggestions to determine if you have the best lawyer for your legal representation. Whether you are currently navigating a legal challenge or simply seeking to understand more about what makes the ideal lawyer stand out, this post is for you.

Open and Consistent Communication

One of the most important things you should be aware of when working with your lawyer is experiencing open and consistent communication. You should feel well-informed about your case’s progress and confident that your inquiries and concerns are addressed in a timely and thorough manner. The ideal lawyer who prioritizes keeping you updated via emails, meetings, or phone calls, and is readily available for discussions is often a sign of a committed and attentive legal representative.

Adherence to Deadlines

The right lawyer understands the importance of legal timelines and adheres strictly to deadlines, ensuring that all necessary documents and actions are completed well within the required timeframes. This level of organization and punctuality not only advances your case efficiently but also reflects a professional who is managing your case with the attention it deserves.

Engagement and Dedication

Feeling that your lawyer is genuinely engaged and dedicated to your case is definitely reassuring. When your lawyer shows a clear understanding of your situation, is proactive in strategy development, and demonstrates excitement in representing your interests, it shows that they are paying attention to your case and giving it the attention it deserves.

The right lawyer is one who is visibly invested in achieving the best outcome for you and who treats you not as a case but as a person. When they are dedicated to you as an individual, they clearly value your success.

Transparent Billing Practices

Transparency in billing and a clear explanation of costs associated with your case signifies that you are working with the right lawyer. A legal team that provides detailed invoices and explains billing practices upfront fosters trust and ensures that you are fully aware of how legal fees are structured and applied.

Strategic and Tailored Approach

When your lawyer has a strategic approach tailored specifically to your case, it is a positive indicator of their competence and commitment. This means they have taken the time to understand the differences in your situation and have developed a plan that maximizes the chances of a favourable outcome, demonstrating both expertise and a personalized approach to your legal needs.

At Foisy & Associates, we use a project management approach to support your case. This style ensures that you have the support, attention, and dedication from our team to ensure your case gets the settlement it deserves.

You Feel Informed and Confident

Having a lawyer who makes complex legal concepts understandable and ensures you are fully informed at every step allows you to make educated decisions about your case. The right lawyer will walk you through every step of the process and ensure you understand what is happening before they continue. This level of empowerment and confidence in your legal understanding is a key sign you are working with the right professional.

Trust and Comfort

Feeling a sense of trust and comfort with your lawyer is invaluable. This includes trusting their advice, feeling confident in their abilities, and being comfortable with their approach to your case. When you have a strong sense of confidence in your legal representation, it significantly contributes to a more positive and less stressful legal experience.

Professionalism and Mutual Respect

Experiencing a high level of professionalism and mutual respect in your interactions with your lawyer indicates a healthy and productive attorney-client relationship. This includes courteous communication, respect for your time and concerns, and professional conduct in all aspects of your case management.

At Foisy & Associates, we are dedicated to providing our clients with the highest level of legal representation and support. Our commitment to being not only the best lawyers but the right lawyers for our clients is a testament to our commitment to delivering quality results. Ready to work with our team? Contact us today for a free consultation and learn how we can help.

Roger R. Foisy, Harpreet S. Sidhu, Daniel Berman, and Rutumi Tank are experienced Ontario Personal Injury Lawyers with extensive experience in motor vehicle accidents, trips, slips, and falls, and long-term disability cases. If you have been injured in a motor vehicle accident, trip, slip, or fall, and/or your long-term disability benefits are terminated, please get in touch with us for immediate support and a free consultation.

Understanding and Advocating for Your Child: Navigating Paediatric Traumatic Brain Injuries (TBIs)

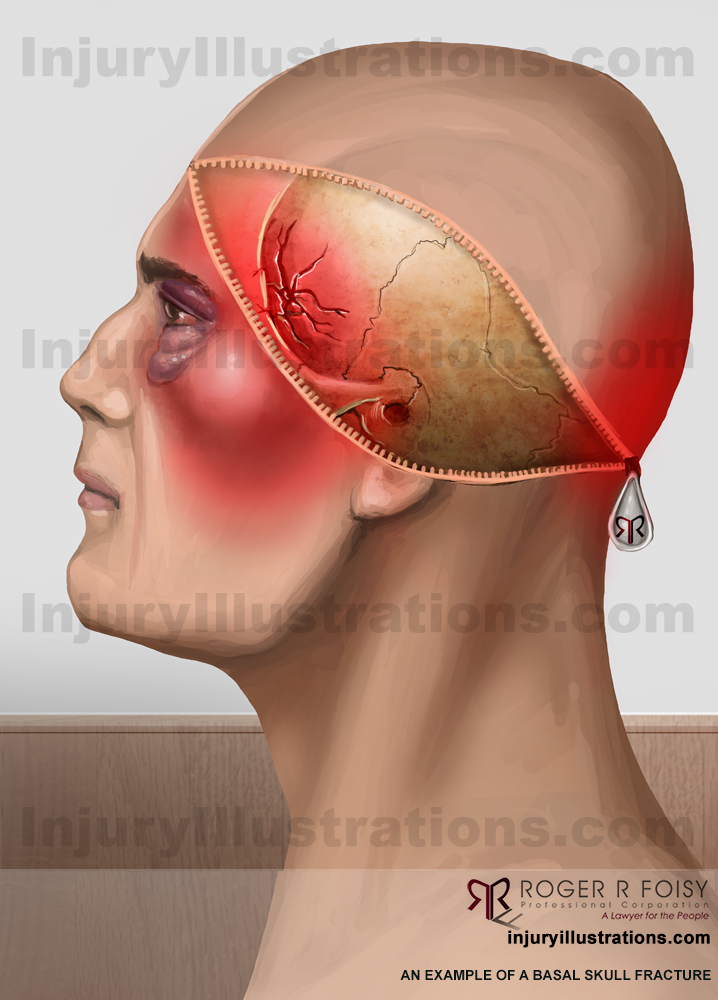

In Ontario, head injuries stand as the number one cause of reported injuries among children aged 1-17, according to the 2019 Canadian Health Survey of Children and Youth. While many head injuries in children fortunately result in quick recoveries, the journey through a traumatic brain injury (TBI) can be fraught with uncertainty, especially considering the potential long-term impacts on a child’s development.

In Ontario, head injuries stand as the number one cause of reported injuries among children aged 1-17, according to the 2019 Canadian Health Survey of Children and Youth. While many head injuries in children fortunately result in quick recoveries, the journey through a traumatic brain injury (TBI) can be fraught with uncertainty, especially considering the potential long-term impacts on a child’s development.

In these challenging times, knowledge and compassion become invaluable allies. Understanding TBIs, recognizing their symptoms, and knowing the steps to take following an injury are crucial in advocating for your child’s well-being and securing the support and compensation they rightfully deserve.

What is a paediatric TBI?

Traumatic brain injuries, or TBIs, are a broad term used to describe a range of symptoms that differ in severity from mild to moderate to severe, occurring from both direct impacts to the head and indirect traumas.

Paediatric traumatic brain injury is not just a medical term; it represents a significant disruption in the lives of children and their families. While many children recover swiftly from TBIs, it is essential to acknowledge that for some, the road to recovery may be longer, with impacts that could last a lifetime.

Causes of TBIs in Children

The American Speech-Language-Hearing Association identifies several common causes of TBIs in children:

- Falls: Over 50% of paediatric TBIs result from falls, including slips, trips on playground equipment, or falls due to unsafe objects.

- Sports Injuries: Nearly 25% of TBIs in children occur from impacts, such as being struck by a ball or other objects.

- Motor Vehicle Accidents: Accounting for nearly 7% of TBIs in adolescents, these injuries can occur even with safety precautions like car seats and seat belts.

- Abuse: Sadly, nearly 3% of TBI cases in children are caused by assault and abuse. This includes infants who have shaken baby syndrome.

- Unknown Causes: Over 15% of TBIs in children have undetermined causes, often due to the challenges in communication with young children.

Significance of TBIs in Minors

Paediatric brain trauma, while often overshadowed by its immediate physical impact, harbours the potential for far-reaching and long-lasting risks that can significantly alter the course of a child’s life.

While a child’s brain possesses a remarkable capacity for healing, this resilience does not fully shield them from the latent dangers of TBIs. Research has shown that almost one-third (31%) of children and adolescents may grapple with persistent physical, cognitive, or emotional symptoms beyond one-month post-injury, often referred to as post-concussion syndrome.

The implications of this are profound, considering that a child’s brain continues to develop well into their mid-twenties. The disruption caused by TBIs can lead to noticeable changes in a child’s cognitive functions, emotional regulation, and overall maturity. In many cases, the full extent of these alterations may not become apparent until the child reaches an age where more complex cognitive abilities and social behaviours are expected.

Overall, the impact of a severe TBI stretches beyond the immediate aftermath, potentially influencing every aspect of a child’s life, from educational achievements to social interactions and future opportunities.

It is this deep and pervasive impact of TBIs that underscores the necessity of timely intervention and comprehensive support. Securing early and effective help is not just a matter of addressing immediate health concerns; it is a critical step in shaping a child’s long-term wellbeing and ensuring the best possible outcome for their future.

Recognizing the Signs: Symptoms of TBI in Children

Symptoms of TBIs can be subtle or pronounced, and they vary widely.

According to the Centre for Childhood Disability Research at McMaster University, symptoms of concussions (a form of traumatic brain injury) in infants and toddlers include the following:

- headache

- nausea or vomiting

- loss of balance

- disinterest in toys

- irritability

- changes in sleeping and eating habits

- fatigue

- light and noise sensitivity

Other symptoms of traumatic brain injuries in children include:

- changes in bowel and bladder function

- loss of consciousness

- impaired movement

- seizures

- visual problems

- auditory dysfunction including vertigo, tinnitus, and difficulty hearing

- Poor coordination and loss of balance

- Irritability

- Changes in sleeping habits

- And more

Immediate Steps and Legal Considerations

If you suspect your child has suffered a TBI:

- Seek medical attention immediately. A prompt and accurate diagnosis is key to recovery.

- Follow all medical advice and attend follow-up appointments. Recovery can be a gradual process requiring patience and persistence.

- Consider various treatments like physical therapy or counselling to support your child’s recovery journey.

At Foisy & Associates, we understand the complexities and challenges faced by families dealing with paediatric TBIs. If you believe your child’s TBI was caused by someone else’s negligence, we are here to support you. We will meticulously review your case and medical records and explore all avenues of compensation to ensure your child receives full and fair compensation for their injuries. This support can be pivotal in securing the financial means for your child’s future medical and therapeutic needs.

Are you or a loved one currently dealing with a potential paediatric TBI caused by negligence? Contact us for a free consultation. Foisy & Associates is a team with extensive experience in handling complex personal injury and accident benefit cases and are lawyers for the people who fight to receive maximum dollars for their clients.

Roger R. Foisy, Harpreet S. Sidhu, Daniel Berman, and Rutumi Tank are Ontario Personal Injury Lawyers with extensive experience in helping clients with brain injuries receive compensation. If you or your child has suffered a brain injury, please get in touch with us for immediate support and a free consultation.

Season’s Greetings and a Happy New Year from Foisy & Associates

As the festive season approaches, we at Foisy & Associates wish to extend our warmest season’s greetings and best wishes for a happy new year to all. The holidays are a special time to gather with loved ones and enjoy moments of relaxation and calm. As we bid farewell to the year and welcome 2024, we encourage everyone to take this time to rest, rejuvenate, and cherish the company of family and friends.

As the festive season approaches, we at Foisy & Associates wish to extend our warmest season’s greetings and best wishes for a happy new year to all. The holidays are a special time to gather with loved ones and enjoy moments of relaxation and calm. As we bid farewell to the year and welcome 2024, we encourage everyone to take this time to rest, rejuvenate, and cherish the company of family and friends.

In the upcoming year, Foisy & Associates plans to remain dedicated to providing the highest quality service and personalized attention to each of our clients. Our focus remains steadfast on ensuring that those we represent receive the maximum disability and personal injury settlements they deserve. We are continually enhancing our skills and resources to meet and exceed your expectations in the coming year.

Holiday Hours

Please note our adjusted hours for the holiday season.

December 25-26: Closed

December 27-29: Open

January 1: Closed

January 2: Open

Our 12 Days of Christmas Giving

At Foisy & Associates, the spirit of giving is an integral part of our holiday tradition. This year, we are proud to continue our annual holiday charity practice with our “12 Days of Christmas” initiative. Each staff member at our firm contributed to a fund for purchasing gift cards, which will be distributed to twelve deserving families in our community. In a gesture of solidarity and support, Foisy & Associates matched every donation made by our team.

In addition to the gift cards, we have crafted twelve heartfelt Christmas cards to accompany the gift to these families. It is our way of spreading holiday cheer and letting them know they are in our thoughts during this festive season.

As we celebrate this season of giving and togetherness, we want to thank our clients and the community for their continued trust and support. From our family at Foisy & Associates to yours, we wish you a peaceful, joyful holiday season and a prosperous New Year.

LAT Decision Impacts Claiming Brokerage Fees for Injured Persons

At Foisy and Associates, we are dedicated to ensuring that our clients receive the justice they deserve, especially in the realm of personal injury law. We are pleased to announce our latest victory in the case of Radebach v Intact Insurance Company, a decision that has garnered attention industry-wide for its impact and implications for future personal injury law cases.

At Foisy and Associates, we are dedicated to ensuring that our clients receive the justice they deserve, especially in the realm of personal injury law. We are pleased to announce our latest victory in the case of Radebach v Intact Insurance Company, a decision that has garnered attention industry-wide for its impact and implications for future personal injury law cases.

For those unfamiliar with the specifics of the case, Radebach v Intact Insurance Company revolved around crucial issues related to insurance claims and the rights of individuals seeking compensation, specifically regarding brokerage fees.

Insurance Companies and Brokerage Fees

For years, there have been issues with insurance providers regarding the responsibility of brokerage fees. For those unaware, brokerage fees are a cost that arises when a treatment provider (e.g. occupational therapist) is responsible for planning treatment for a client, like the organization of meetings and appointments, communicating and coordinating treatment from different providers, and more.

In catastrophic cases, insurance providers assign their claimant a case manager who takes on these responsibilities. This simplifies the case and makes it easier for the client. In these cases, the brokerage falls to the case manager to organize.

In non-catastrophic cases, insurance providers do not provide coverage for a case manager, and instead, this responsibility falls to the claimant, their family, and their medical providers to complete. When medical providers are involved in the planning and coordination of treatment like this, they charge a brokerage fee to pay for their services.

Insurance providers, however, have largely been unwilling to pay such brokerage fees. Their claim is often that because they do not pay for a case manager for non-catastrophic clients, they should not pay brokerage fees either. Instead, they have recommended that providers set aside time in their client appointments to communicate with other providers, coordinate treatments, and complete other work of this kind that is non-treatment related but is to the benefit and safety of the client. For several reasons, this is not possible or realistically achievable.

Radebach v Intact Insurance Company

In this precedent-setting case, Radebach v Intact Insurance Company, our client was denied brokerage fees, despite being a catastrophic claimant. While brokerage fees are generally accepted by insurance when charged by a case manager, in this situation the brokerage fees were charged by an occupational therapist, so the insurance provider denied the claim.

Our team decided to push this case; in most situations where we receive a case of this kind, the insurance company settles with us before the case is brought to an appeal. However, doing so also means that the insurance company continues to deny brokerage fees in the future. Our team refused to cave and pursued the appeal to finally get some answers from the License Appeal Tribunal (LAT).

We are pleased that once the appeal was heard, the adjudicator found that the request for payment of brokerage fees was deemed reasonable and necessary.

We are proud of our team’s hard work and are grateful for the support and recognition from esteemed organizations like the Ontario Rehab Alliance. In their August 2023 newsletter, the Ontario Rehab Alliance highlighted the importance of this decision, emphasizing its potential implications for future cases and the broader landscape of personal injury law in Ontario. Their recognition of our efforts and the positive outcome of this case is a testament to the dedication and expertise of our team.

This case serves as a reminder of the importance of robust legal representation in personal injury matters and the significant impact such representation can have on the lives of individuals seeking justice.

For a detailed overview of the Radebach v Intact Insurance Company decision, please visit our reported decisions page.

Are you looking for a lawyer to assist you with your LAT appeal? Contact us for a free consultation. Foisy & Associates is a team with extensive experience in handling complex personal injury and accident benefit cases and are lawyers for the people who fight to receive maximum dollars for their clients.

Roger R. Foisy, Harpreet S. Sidhu, Daniel Berman, and Rutumi Tank are Ontario Personal Injury Lawyers with extensive experience in motor vehicle accident cases before the LAT and courts. They are strongly supported by Rusald Laloshi, a senior paralegal who has also represented many clients before the LAT. If you have been injured in a motor vehicle accident, please get in touch with us for immediate support and a free consultation.

The Risks of Settling Your Entire Accident Benefits Claim

Navigating the aftermath of a motor vehicle accident can be daunting, especially when it comes to dealing with insurance claims and potential settlements. Among the various options presented to you, a ‘full and final settlement’ of your accident benefits claim is a proposal sometimes offered by your insurer after you appeal the denial of various accident benefits to the Licence Appeal Tribunal (LAT).

What does it mean to accept a full and final settlement of your accident benefits claim? How does it impact your rights as a claimant, and how can it influence your future, particularly if your injuries have long-lasting effects?

By examining what a full and final settlement is, the risks of accepting it, and how a lawyer helps you accurately assess the value of your case, you will be better prepared to navigate the complexities of your claim and protect yourself in the future.

What is a Full and Final Settlement?

A full and final settlement is an agreement you reach with your insurance provider after a motor vehicle accident. This agreement is a specified amount of money, mutually agreed upon to cover all claims for benefits – past, present, and future – that arise from the accident, as against the accident benefits insurer. These claims can encompass a variety of accident benefits from medical and rehabilitation, attendant care, housekeeping (if your injuries have been deemed Catastrophic or if optional benefits have been purchased under the policy), income replacement benefits, non-earner benefits, or caregiver benefits.

Generally, the settlement is given to you, the claimant, as a lump-sum payment and requires consent from both you and the insurer. The primary purpose of this arrangement is to provide you with closure and support while also limiting the future financial risk for your insurance provider.

Why You Should Not Agree to a Full and Final Settlement

While it may initially appear beneficial to agree to a full and final settlement of your claim with your insurance provider, it is crucial to consider the long-term implications of such a decision. When you find yourself at a LAT hearing and are offered a settlement, for instance, the future impact of your injuries might be unclear. In such a state of uncertainty, signing off on a full and final settlement implies accepting a definite sum to support your injury, eliminating any chance for further assistance down the line.

Additionally, the severity of your injuries can often be underestimated. In most cases, the full extent of damage from an accident, including the treatment you may need, such as surgery, attendant care, income replacement and other support, can take several months or even years to materialize. There is also the possibility of complications during recovery, which would require additional financial aid. It is important to envision potential future scenarios, so consider the following before agreeing to a settlement:

Will you have a permanent disability in the future?

Will you be able to perform your job effectively after your settlement?

Have you had surgery, or will you need it in the future because of your injury? If so, what are the potential risks of the surgery?

Will you need to see a therapist to deal with the mental impact and events of the accident?

What rehabilitation costs may arise in the future?

A full settlement also limits your right to pursue a determination of catastrophic impairment. This opportunity is forfeited once you’ve settled your entire accident benefits claim with your insurance provider.

Lastly, remember that while dealing with the LAT, you may find your insurer offering a full settlement for your claim even though your appeal pertains to only a portion of the claim, such as medical rehabilitation benefits or income replacement benefits. Be wary of such instances and remember, it’s crucial to think long-term when it comes to settling your claim. While a full and final settlement of your entire claim may seem appealing in the short-term, especially if you are in desperate need of treatment and/or financial support, doing so may be detrimental to your long-term health and finances if you have not considered the questions above.

How to Know What Your Case is Worth

Knowing the value of your case is critical in ensuring you receive a fair settlement. A qualified and knowledgeable lawyer, backed with experience, will provide the essential support needed to navigate your claim. A personal injury lawyer from our team will effectively assess the quality of an offer and will guide and inform you when a settlement does not align with your current and (potential) future needs.

Are you looking for a lawyer to assist you with your LAT appeal? Contact us for a free consultation. Foisy & Associates is a team with extensive experience in handling complex personal injury and accident benefit cases and are lawyers for the people who fight to receive maximum dollars for their clients.

Roger R. Foisy, Harpreet S. Sidhu, Daniel Berman, and Rutumi Tank are Ontario Personal Injury Lawyers with extensive experience in motor vehicle accident cases before the LAT and courts. They are strongly supported by Rusald Laloshi, a senior paralegal who has also represented many clients before the LAT. If you have been injured in a motor vehicle accident, please get in touch with us for immediate support and a free consultation.

Understanding Your Rights to Access Personal Information from the Police

Accessing records from the Ontario Provincial Police (OPP) or municipal police can provide crucial information for personal injury victims, particularly in motor vehicle accident cases. In Ontario, individuals have the right to request records containing their personal information, including 911 calls, from the OPP or municipal police services. However, navigating the process and understanding your rights is essential.

This post explores accessing records that contain your personal information, considerations of exemptions and personal privacy, and highlights a recent decision that illustrates the challenges and victories in obtaining this vital information.

Understanding Your Rights: Access to 911 Calls

When you have been involved in a motor vehicle accident, it is essential to understand your rights regarding access to your personal information.

In Ontario, you have the right to request records that contain your personal information from the OPP or any municipal police service. This can be a valuable resource for obtaining crucial information related to your incident. Whether you request this information yourself or through a lawyer, the process typically involves submitting a formal request form and paying a required fee.

The information you can access includes incident and investigation reports, witness statements, Crown or police briefs, records of arrest, officers’ notes, and police-related 911 calls. These records often provide valuable insights into the accident’s circumstances, aiding in understanding what transpired and supporting your case when legal action is pursued.

Exemptions and Personal Privacy

While you have the right to request access to your personal information, it is important to be aware of the exemptions outlined in the Freedom of Information and Protection of Privacy Act. These exemptions may allow the police to deny your request for specific reasons.

There are mandatory and discretionary exemptions; for example, if disclosing certain information infringes upon someone else’s privacy rights, your request may be denied.

This can create challenges when you require access to information that you did not personally provide. For instance, in a recent case we handled, we were initially denied access to 911 calls relating to our client’s incident as they were made by a third party. This highlights the potential hurdles you may encounter when seeking information that involves the actions or privacy of others.

Appealing a Denial to Access Information

Foisy & Associates recently achieved a victory in overturning the Ministry of the Solicitor General (Ministry) ‘s decision to deny access to 911 calls pertaining to our client’s motor vehicle accident. Our initial request for the 911 calls aimed to better understand our client’s injuries and state of mind immediately following the collision.

The Ministry first denied our request, citing the third-party nature of the witness’ call and the Freedom of Information and Protection of Privacy Act. However, we emphasized that our client’s interest lay solely in the information provided by the caller, not their identity or contact details. Given our client’s head injury and loss of consciousness, accessing the 911 calls would give vital insight into their well-being in the critical moments after the accident. Despite our clarification, the Ministry denied access once again.

Undeterred, we appealed the decision to the Information and Privacy Commissioner of Ontario. In a favourable outcome, it was determined that the Ministry must disclose the requested 911 calls. Since neither call contained personal information or identified the callers and considering our client’s memory loss due to their sustained injury, the calls were deemed relevant to our client’s collision. We were given access to the records.

For more information about this reported decision, please visit the reported decision’s page.

You Can Fight to Receive Information

If you have been denied information by the Ministry, it is important to know that not all hope is lost. With valid reasoning, appealing to the Information and Privacy Commissioner of Ontario may allow you access to these records.

Obtaining access to records with your personal information can be a pivotal step in gathering critical evidence to support your personal injury or long-term disability claim. As you move forward, it is crucial to have a legal team by your side that is committed to fighting for your rights and pushing for the results you deserve.

If you or someone you love has been denied benefits by your automobile insurance or long-term disability provider, we encourage you to contact us for a free consultation. Roger R. Foisy & Associates is a team with extensive experience in handling complex personal injury and long-term disability cases, and are lawyers for the people who fight to receive maximum dollars for their clients.

Roger R. Foisy, Harpreet S. Sidhu, Daniel Berman are Ontario Personal Injury Lawyers with extensive experience in motor vehicle accident cases. They are strongly supported by Rusald Laloshi, a senior paralegal who has also represented many clients before the LAT. If you have been injured in a motor vehicle accident, please get in touch with us for immediate support and a free consultation.

How to Prepare for Your LAT Hearing: 9 Steps Your Lawyer Should Take to Get You Ready

When it comes to a Licence Appeal Tribunal (LAT) hearing, preparation is key. At Foisy & Associates, we take several crucial steps to ensure our clients are well-equipped for their hearing. While the process may differ from case to case, we follow a general approach that empowers our clients to feel confident and ready for the tribunal.

A LAT hearing can be daunting, but our legal team is here to help. Learn about the steps we take to support our clients in feeling ready for their hearing.

- Understanding the process:

We start by explaining the LAT hearing process to our clients, including its purpose, structure, and potential outcomes. This helps you know what to expect and feel more at ease during the hearing. - Review the case:

Each case is reviewed with our client, going over the facts, evidence, and legal arguments. Reviewing helps clients understand the strengths and weaknesses of their case. We also discuss any potential challenges that may arise during the hearing. - Prepare documents:

We ensure that all relevant documents and evidence are organized and submitted to the Tribunal promptly. Documents submitted include medical records, expert reports, a Witness Will Say, and any other pertinent documents. - Develop a strategy:

Together with our clients, we develop a clear and concise strategy for presenting their cases. This may involve deciding which arguments to emphasize, what evidence to present, and how to best address any weaknesses in the case. - Practice testimony:

We help our clients prepare for giving testimony during the hearing. We understand this is a very stressful part of the case, so we focus our time on answering potential questions, guiding clients on how to present themselves confidently, and advising them on handling cross-examination. - Familiarize with the hearing room:

We help our clients understand what a virtual hearing will comprise of, and all the participants involved on any given day of testimony. This allows our clients to feel more comfortable and reduce anxiety on the day of the hearing. - Address logistical details:

We make sure to keep our clients informed about the schedule of the LAT hearing, which includes the specific date and time of witness testimony. Additionally, we also provide any necessary guidelines or procedures that our clients need to follow during the hearing. - Emotional support:

The LAT hearing can be an emotionally challenging experience. Our team can arrange for emotional support and reassurance, helping our clients maintain a positive attitude and confidence throughout the process. - Post-hearing follow-up:

After the LAT hearing, we will debrief with our clients, discussing how the evidence unfolded, potential next steps, anticipated waiting times for the decision rendering, and addressing any concerns or questions our clients may have.

At Foisy & Associates, we understand the challenges that come with preparing for a Licence Appeal Tribunal hearing. However, by following the steps outlined above and working with our experienced legal team, our clients can feel confident and well-prepared for their hearing. We are dedicated to providing personalized attention and support to each of our clients to ensure they receive the best possible outcome for their case.

If you or someone you love has been denied accident benefits by your automobile insurance provider, we encourage you to contact us for a free consultation. Foisy & Associates is a team with extensive experience in handling complex personal injury and long-term disability cases, and are lawyers for the people who fight to receive maximum dollars for their clients.

Roger R. Foisy, Harpreet S. Sidhu, Daniel Berman, and Rutumi Tank are Ontario Personal Injury Lawyers with extensive experience in motor vehicle accident cases. They are strongly supported by Rusald Laloshi, a senior paralegal who has also represented many clients before the LAT. If you have been injured in a motor vehicle accident, please get in touch with us for immediate support and a free consultation.

How a Project Management Approach Helps Your Case

At Foisy & Associates, we understand that personal injury and denied disability cases can have a significant impact on our clients’ lives. We recognize that our clients are often facing physical, emotional, and financial challenges, and we are committed to providing compassionate and effective representation.

Foisy & Associates operates as a project management law firm that dedicates itself to the handling of personal injury and denied disability cases while utilizing project management principles to enhance efficiency, client satisfaction, and overall case outcomes.

A project management approach in a personal injury law firm involves applying project management best practices to personal injury cases. The goal of such an approach is to ensure that clients receive effective representation and compensation for their injuries in a timely and efficient manner.

Our project management approach is not just about streamlining processes and maximizing efficiency; it’s about putting our clients first. We believe that every client deserves personalized attention and a customized strategy to achieve the best possible outcome for their case.

Key aspects of project management that we use at our law firm include the following:

- Case Management: Our firm uses project management methodologies, to streamline case processing and ensure timely completion. This involves breaking down cases into smaller tasks or milestones, assigning responsibilities to team members, and regularly reviewing progress.

- Collaboration: A strong emphasis is placed on teamwork and open communication among lawyers, paralegals, support staff, and external collaborators, such as health practitioners, medical experts, and rehab professionals. This collaboration ensures that all parties involved are working towards a common goal and staying informed about case developments.

- Client Communication: Our firm prioritizes effective and transparent communication with clients, keeping them informed of case progress, strategy decisions, and potential outcomes. This may include regular updates, meetings, or consultations to ensure that clients are fully engaged in the process.

- Resource Allocation: Our firm efficiently allocates resources, such as time, personnel, and financial commitment, to maximize the potential for successful case outcomes. This includes prioritizing cases based on their complexity, and client needs.

- Continuous Improvement: Our project management law firm is committed to evaluating and refining its processes to optimize performance continually. This might involve analyzing case outcomes, soliciting client feedback, and implementing new technologies or practices to enhance efficiency and client satisfaction.

- Risk Management: The firm proactively identifies and mitigates potential risks associated with each case, such as evidentiary challenges, legal obstacles, or financial concerns. This approach helps to improve the likelihood of success and minimize negative impacts on the client and the firm.

At Foisy & Associates, our project management approach enhances our ability to streamline case processing, maximize efficiency, and improve outcomes for our clients. Our focus on collaboration, client communication, resource allocation, continuous improvement, and risk management ensures that our clients receive personalized attention and customized strategies to achieve successful case outcomes.

By using a project management approach, we can efficiently allocate resources, proactively manage risks, and continually refine our processes to enhance efficiency and client satisfaction. This ultimately results in the timely and effective resolution of cases, saving our clients time and money.

At Foisy & Associates, we are dedicated to providing our clients with the highest level of legal representation and support. Our commitment to using project management best practices is a testament to our commitment to delivering quality results for our clients. Ready to work with our team? Contact us today for a free consultation and learn how we can help.

Roger R. Foisy, Harpreet S. Sidhu, and Daniel Berman are experienced Ontario Personal Injury Lawyers with extensive experience in motor vehicle accidents, trips, slips, and falls, and long-term disability cases. If you have been injured in a motor vehicle accident, trip, slip, or fall, and/or your long-term disability benefits are terminated, please get in touch with us for immediate support and a free consultation.

What is Catastrophic Impairment?

When an automobile accident occurs, the consequences can be life altering. For some, the injuries sustained can lead to a determination of catastrophic impairment. Understanding what catastrophic impairment is, how it’s defined in Ontario, and who makes a determination will allow you to be better prepared in the situation where you have suffered a permanent injury and believe you are catastrophically impaired.

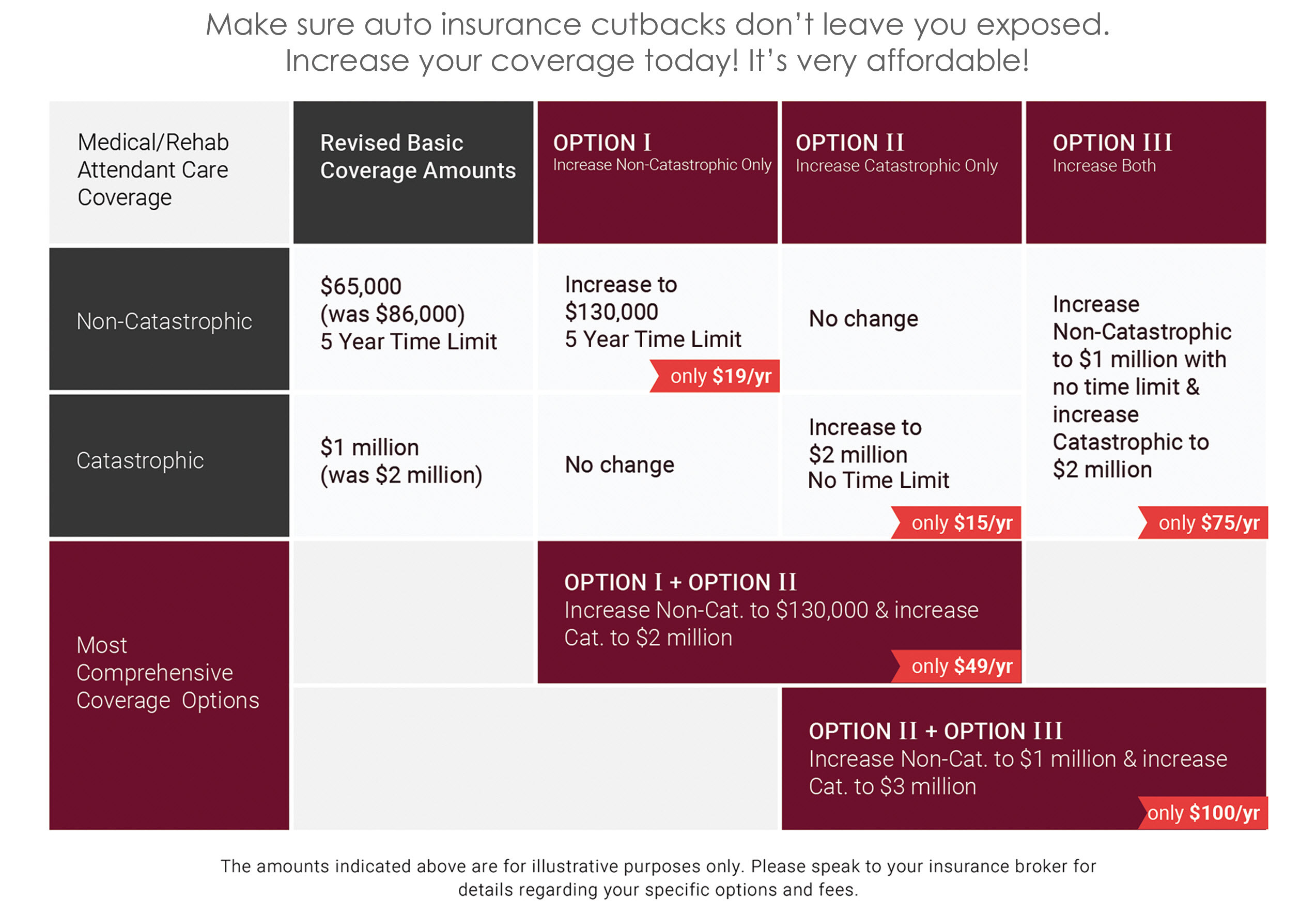

Catastrophic impairment is a legal definition constructed by the Statutory Accident Benefits Schedule (SABS) to govern accident benefits claims. In Ontario, individuals who are considered catastrophically impaired are entitled to more substantial accident benefits than someone who experiences non-catastrophic or minor injuries.

Types of Injury Impairment

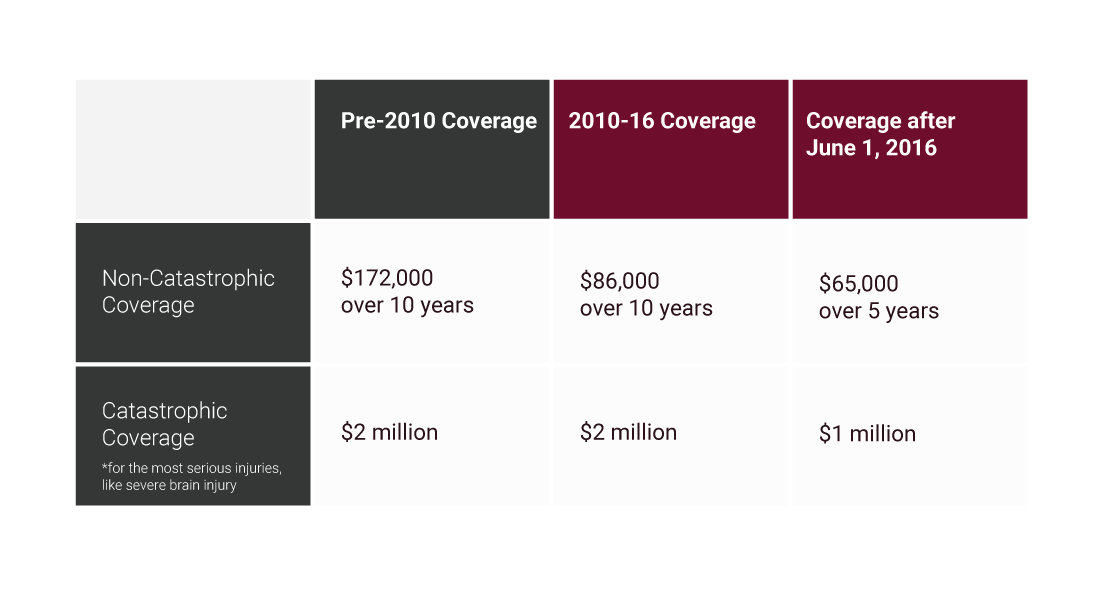

The SABS sets out three categories of injuries to determine how much money will be available to an individual after being injured in an automobile accident. Each person’s situation may differ depending on the type of benefits they have chosen, as optional benefits may entitle a person to further coverage.

Minor Injury Guideline

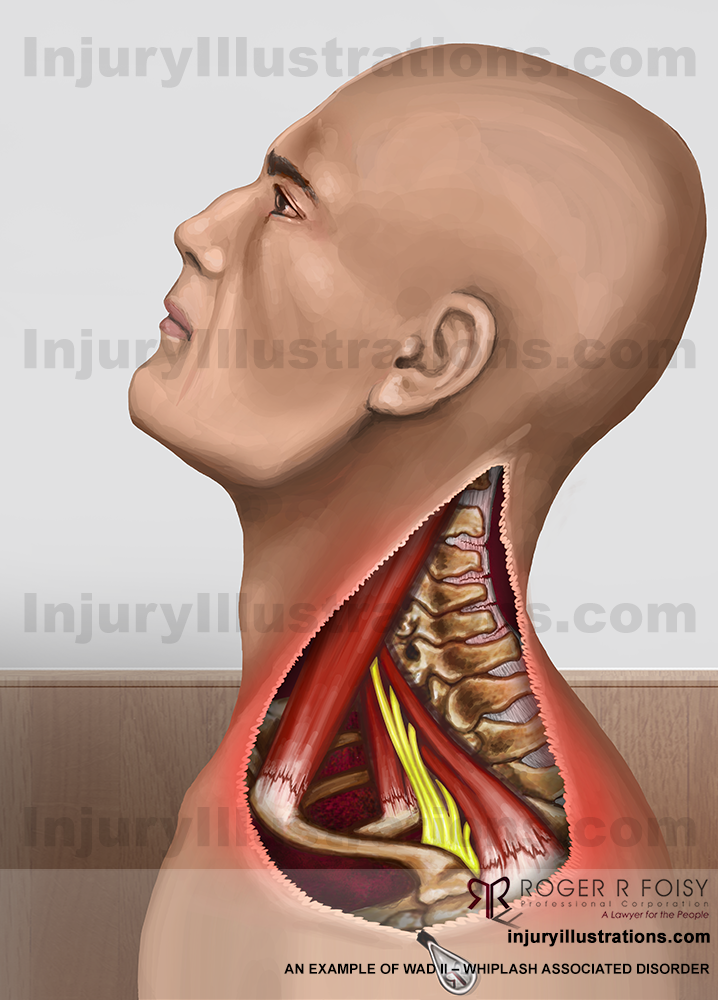

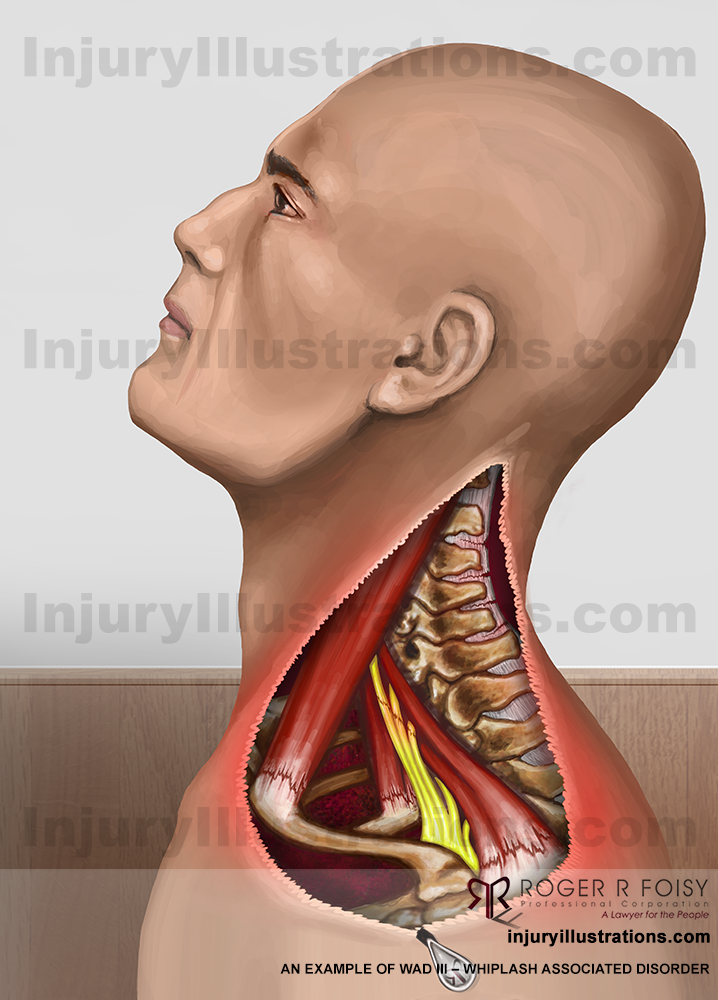

An individual will be classified under the Minor Injury Guideline (MIG) if they experience whiplash-related injuries, muscle strains or strains, contusions, or lacerations. An individual who falls under the MIG is entitled to $3,500 for their medical rehabilitation needs.

Non-Catastrophic Injuries

An individual who does not fall into the MIG will be classified as non-catastrophic. This typically provides up to $65,000 of medical rehabilitation and attendant care funding for up to five years from the date of the accident. For minors who have suffered injuries relating to a motor vehicle accident the duration of these benefits is funded for no more than 10 years for a minor who was 15 to 17 years old at the time of the accident; or until the minor turns 25 years old, if the minor was less than 15 years old at the time of the accident.

Catastrophic Injury

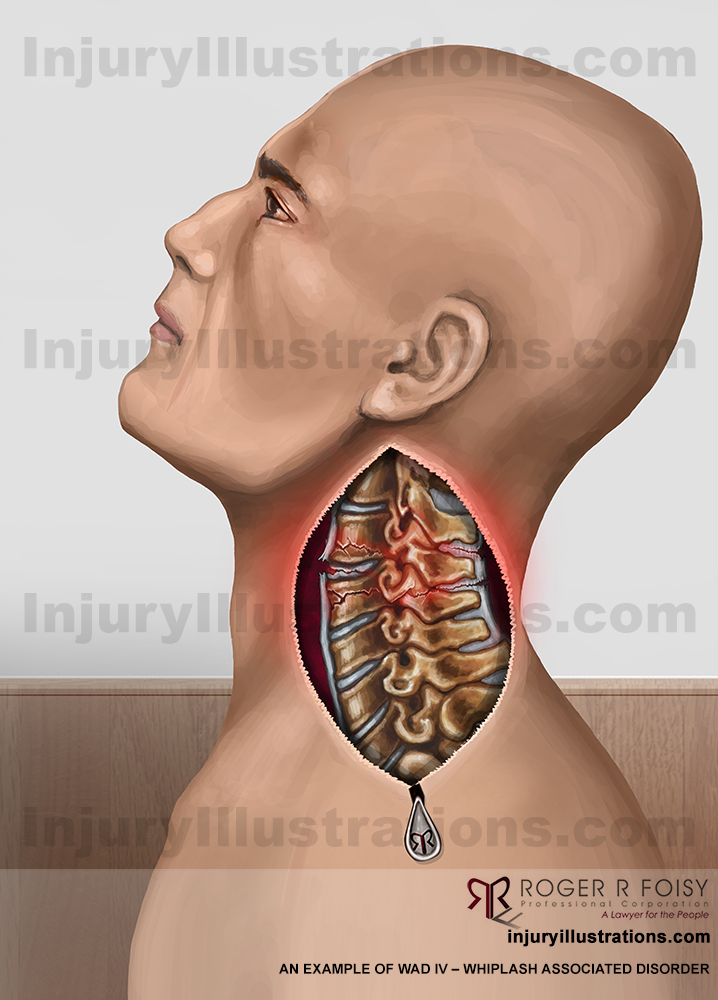

If a person has sustained more serious injuries than indicated in the MIG or non-catastrophic designations, they may meet the description of catastrophic impairment. To be found catastrophically impaired, a person must meet certain criteria as set out in the SABS.

A person who has suffered catastrophic impairment is entitled to a minimum of one million dollars over their lifetime for medical, rehabilitation, and attendant care benefits.

Catastrophic Impairment Criteria in Ontario

When determining catastrophic impairment designation, the SABS looks at impairments rather than the injury itself. The current (post-June 2016) legislation describes the following as “catastrophic impairments”:

- Paraplegia or tetraplegia that meets the following criteria:

- The insured person’s neurological recovery is such that the person’s permanent grade on the ASIA Impairment Scale can be determined.

- The insured person’s permanent grade on the ASIA Impairment Scale is or will be,

- A, B or C, or

- D, and

- the insured person’s score on the Spinal Cord Independence Measure is 0 to 5,

- the insured person requires urological surgical diversion, an implanted device, or intermittent or constant catheterization to manage a residual neurological impairment, or

- the insured person has impaired voluntary control over anorectal function that requires a bowel routine, a surgical diversion, or an implanted device.

- Severe impairment of ambulatory mobility or use of an arm, or amputation that meets one of the following criteria:

- Trans-tibial or higher amputation of a leg.

- Amputation of an arm or another impairment causing the total and permanent loss of use of an arm.

- Severe and permanent alteration of prior structure and function involving one or both legs as a result of which the insured person’s score on the Spinal Cord Independence Measure is 0 to 5.

- Loss of vision in both eyes that meets the following criteria:

- Even with the use of corrective lenses or medication,

- visual acuity in both eyes is 20/200 (6/60) or less as measured by the Snellen Chart or an equivalent chart, or

- the greatest diameter of the field of vision in both eyes is 20 degrees or less.

- The loss of vision is not attributable to non-organic causes.

- Even with the use of corrective lenses or medication,

- If the insured person was 18 years of age or older at the time of the accident, a traumatic brain injury that meets the following criteria:

- The injury shows positive findings on a computerized axial tomography scan, magnetic resonance imaging, or any other medically recognized brain diagnostic technology indicating intracranial pathology that is a result of the accident, including but not limited to, intracranial contusions or haemorrhages, diffuse axonal injury, cerebral edema, midline shift or pneumocephaly.

- When assessed in accordance with the Glasgow Outcome Scale, and the Extended Glasgow Outcome Scale the injury results in a rating of,

- Vegetative State (VS or VS*), one month or more after the accident,

- Upper Severe Disability (Upper SD or Upper SD*) or Lower Severe Disability (Lower SD or Lower SD*), six months or more after the accident, or

- Lower Moderate Disability (Lower MD or Lower MD*), one year or more after the accident.

- If the insured person was under 18 years of age at the time of the accident, a traumatic brain injury that meets one of the following criteria:

- The insured person is accepted for admission, on an in-patient basis, to a public hospital named in a Guideline with positive findings on a computerized axial tomography scan, a magnetic resonance imaging, or any other medically recognized brain diagnostic technology indicating intracranial pathology that is a result of the accident, including, but not limited to, intracranial contusions or haemorrhages, diffuse axonal injury, cerebral edema, midline shift, or pneumocephaly.

- The insured person is accepted for admission, on an in-patient basis, to a program of neurological rehabilitation in a paediatric rehabilitation facility that is a member of the Ontario Association of Children’s Rehabilitation Services.

- One month or more after the accident, the insured person’s level of neurological function does not exceed category 2 (Vegetative) on the King’s Outcome Scale for Childhood Head Injury.

- Six months or more after the accident, the insured person’s level of neurological function does not exceed category 3 (Severe disability) on the King’s Outcome Scale for Childhood Head Injury.

- Nine months or more after the accident, the insured person’s level of function remains seriously impaired such that the insured person is not age-appropriately independent and requires in-person supervision or assistance for physical, cognitive, or behavioural impairments for the majority of the insured person’s waking day.

- A physical impairment or combination of physical impairments that, in accordance with the American Medical Association’s Guides to the Evaluation of Permanent Impairment, results in 55 percent or more physical impairment of the whole person.

- A mental or behavioural impairment, excluding traumatic brain injury, determined in accordance with the rating methodology in the American Medical Association’s Guides to the Evaluation of Permanent Impairment, that, when the impairment score is combined with a physical impairment and combining requirements in the guide, results in 55 percent or more impairment of the whole person.

- An impairment that, in accordance with the American Medical Association’s Guides to the Evaluation of Permanent Impairment, results in a class 4 impairment (marked impairment) in three or more areas of function that precludes useful functioning or a class 5 impairment (extreme impairment) in one or more areas of function that precludes useful functioning, due to mental or behavioural disorder.

Determination of Catastrophic Impairment

A determination of catastrophic impairment is usually made by your insurance company at the recommendations of medical professionals. Some injuries, such as paraplegia, total loss of vision in both eyes, and complete loss of use of lower or upper extremities, are automatically deemed as catastrophic.

In most cases the injured person, or their representatives, will obtain medical opinions from experts to support the conclusion that they have reached a permanent impairment that is classified as catastrophic under the law. If the insurer disagrees with the experts, they are entitled to a second opinion and catastrophic impairment assessments from their own experts.

In cases where an insurance company and injured person do not achieve the same conclusion (i.e. one party maintains catastrophic impairment and the other disagrees), the matter will be brought before the Licence Appeal Tribunal. In this situation an adjudicator will allow both parties to present their evidence, and will make a final determination regarding the injured person’s impairment.

Obtaining a determination can be a long, drawn-out process. It is recommended that you work with a personal injury lawyer with experience in catastrophic impairment determinations and who has had experience with appearing before the Licence Appeal Tribunal. A lawyer who can effectively advocate for you and your rights can help guarantee that you are treated fairly and that you receive the appropriate determination.

If you or someone you love has been denied catastrophic impairment by your automobile insurance provider, we encourage you to contact us for a free consultation. Roger R. Foisy & Associates is a team with extensive experience in handling complex personal injury and long-term disability cases, and are lawyers for the people who fight to receive maximum dollars for their clients.

For more information on catastrophic impairment, please visit our Frequently Asked Questions page.

Roger R. Foisy, Harpreet S. Sidhu, and Daniel Berman are Ontario Personal Injury Lawyers with extensive experience in motor vehicle accident cases. They are strongly supported by Rusald Laloshi, a senior paralegal who has also represented many clients before the LAT. If you have been injured in a motor vehicle accident, please get in touch with us for immediate support and a free consultation.

The Importance of Obtaining a Lawyer Who Can Cover Expert Fees

Expert witnesses are essential to appealing a case before the License Appeal Tribunal (LAT), but they can have severe implications for your disbursements if you are not careful.

You may recall from earlier blogs that disbursements are third-party expenses you will pay following the successful resolution of your case. Disbursements are in addition to legal fees, which lawyers charge for the legal services they provide to you for a claim. Disbursements will include the cost of retaining an expert witness.

Expert witnesses specialize in their given field and will give their opinion before a court or a tribunal. A medical expert who testifies in the LAT process provides a medical opinion about an applicant’s injuries concerning a treatment plan, attendant care benefits, income replacement benefits, and even catastrophic impairment determination.

While having such expert witnesses helps bolster your case before the LAT, they can present substantial accounts for their work. Depending on the lawyer you choose, your expert fees can increase over time. Working with a lawyer who pays your expert fees quickly ensures you are not unnecessarily increasing your disbursement account—from interest on overdue accounts—which will be deducted directly from any future settlement of your accident benefits.

Table of Contents

- What do expert witnesses and third-party medical experts do for a case?

- How much do expert fees cost?

- Is the applicant the one who pays?

- Why are certain expert fees substantially higher than others?

- What happens to my expert fees if the LAT denies my appeal?

- What does Roger R. Foisy & Associates do to help?

What do expert witnesses and third-party medical experts do for a case?

When you participate in a LAT hearing, three types of witnesses participate:

- Lay witnesses, like family members and coworkers, know firsthand how an applicant’s function has been affected by the motor vehicle accident

- Treating witnesses, like family doctors, psychologists, and occupational therapists

- And Expert witnesses, who are retained by both you, the applicant, and the insurance company, the respondent

An expert witness is a person permitted to provide their expert opinion because of their unique knowledge and proficiency in a related field to the case – in LAT cases; these are often medical experts.

Expert witnesses are generally asked to answer a mix of legal and medical questions regarding your case. For example, experts may be asked to comment on a legal test or definition that an applicant has to meet to qualify for a particular benefit or to respond to whether an applicant’s requested treatment plan is considered reasonable and necessary for their injuries.

At Roger R. Foisy & Associates, we regularly use experts to comment on whether our client meets a medical-legal definition that renders them catastrophically impaired.

How much do expert fees cost?

The use of experts in a LAT appeal is an important consideration. For one, they can help you prove that a pre-existing condition did not cause your injury; or help to support the need for specific treatment and rehabilitation.

When your legal and medical team believes that your injuries from your motor vehicle accident have rendered you catastrophically impaired, insurance companies will cover up to $2,000 for a single medical expert assessment.

You will often need several expert assessments completed for a catastrophic impairment determination. Suppose you require six different assessments, which could include assessments from a neurologist, an orthopaedic surgeon, an odontologist, a psychiatrist and occupational therapists. In that case, the insurance company could pay up to $12,000 ($2,000 each) for those assessments. However, these expert assessments usually cost more – closer to $5,000-7,000 each. Applicants must realize they become responsible for the fees outside the insurance company’s payments.

If each assessor charges $7,000 and insurance covers only $2,000 of those fees, the applicant becomes responsible for the remaining $5,000 from each assessment. In our example, that would amount to $30,000 outstanding, owed by you!

Remember, though, this is only for a report regarding the determination of catastrophic impairment. Experts who testify in a LAT appeal hearing charge additional fees. Experts generally charge 1-2 hours to meet with your lawyer, 2-3 hours of individual preparation and usually testify before the LAT for half a day (3-4 hours). Depending on an expert’s hourly rate, a client can expect an expert fee to be as low as $1,200 to as high as $10,000 for testifying.

Is the applicant the one who pays?

When appealing to the LAT, we highly recommend that the applicant works with a law firm that will pay their expert fees within 30-90 days upon receipt of an expert’s invoice to avoid accruing unnecessary interest. These expert fees will become a part of the disbursements your lawyer will charge you for their services after the resolution of your case, be it a settlement or a hearing.

Why are certain expert fees substantially higher than others?

Expert fees are usually charged to a law firm upon completing the expert’s service (i.e., a medical opinion report or testimony before a tribunal). If a law firm does not have enough funds to pay the invoice immediately, the expert or law firm may often connect with a litigation loan company that will ensure their fee is paid immediately. That loan company will often act as a creditor charging interest on the invoice paid to the expert on your behalf. Upon resolving your matter, you will now be required to pay the loan company for the cost of the expert report and the interest accrued during this time. This amount becomes a disbursement which will be deducted from the overall monies you can expect to receive from any decision or settlement of your case.

In cases where litigation loan companies are not involved, experts will often charge a more significant fee if they know a law firm will take longer to pay its invoice while it waits to settle. In these situations, these increased fees also become part of your disbursements.

What happens to my expert fees if the LAT denies my appeal?

In this situation, your law firm will still use the expert information in your case outside of the LAT forum, against the person who was at fault in your vehicle accident, as the information obtained will help to win your case.

When your case is settled, the costs for these third-party expert witness fees will be claimed as a disbursement in that case and become payable from your settlement or judgment.

What does Roger R. Foisy & Associates do to help?

Roger R. Foisy & Associates does not use litigation loan companies to pay for experts. They pay each expert within a 30-90 day period from the receipt of the expert report. This ensures that the expert does not have to incorporate additional costs into the invoice. It is well understood that in the personal injury field of practice, experts who are expected to wait to be paid for their services often charge more for their legal opinions. If it takes anywhere from six months to three additional years to settle a case from the delivery of the expert opinion, how much extra will an expert be charging while they wait to be paid for their expert services?

Our law firm team members are trained to ensure that when you only obtain the services of third-party experts you require to prove your claim, you will not pay for more expert assistance than you need. Our lawyers use strategy and consider the many factors of your case to decide when and whom we obtain as third-party experts. We do not treat you as part of a transaction but prioritize working on your case as effectively as possible.

We pledge that the job is done right, and our project management processes save you money in the long term. Our methods to keep you from paying extensive and unnecessary expert fees can help you save tens of thousands of dollars in disbursements.

Are you looking for a lawyer to assist you with your LAT appeal? Contact us for a free consultation. Roger R. Foisy & Associates is a team with extensive experience in handling complex personal injury and accident benefit cases and are lawyers for the people who fight to receive maximum dollars for their clients.

Roger R. Foisy, Harpreet S. Sidhu, and Daniel Berman are Ontario Personal Injury Lawyers with extensive experience in motor vehicle accident cases before the LAT and courts. They are strongly supported by Rusald Laloshi, a senior paralegal who has also represented many clients before the LAT. If you have been injured in a motor vehicle accident, please get in touch with us for immediate support and a free consultation.

Having the Right Legal Representation for the LAT

If you need to go through the Licence Appeal Tribunal (LAT), it is essential to have a representative who can effectively advocate for you and protect your rights and interests. Without legal representation, you may be at a disadvantage and may struggle to present your case effectively. Although it is possible to represent yourself before the LAT, it is usually in your best interests to seek legal counsel to ensure that you are treated fairly and your rights are protected.

What is the Licence Appeal Tribunal?

The LAT is a quasi-judicial agency that reviews applications and resolves disputes related to compensation claims and licensing activities. It is composed of two divisions: the General Service division and the Automotive Accident Benefits Service (AABS). These divisions provide adjudicators who review appeals and try to resolve disputes between claimants and insurance providers.

For more information about the LAT, visit our LAT resources page.

Why do I need legal representation for the LAT?

Technically, you are not required to have a legal representative when you appear before the LAT.

At Roger R. Foisy & Associates, we strongly recommend that you retain the services of a legal representative, whether that be a paralegal or lawyer. Both paralegals and lawyers are governed by the same laws and principles, but there are some differences between the two types of legal representation.

Paralegals may seem to be a more affordable option than a lawyer, however in this area of law paralegals and lawyers charge the same or very similar contingency fee rates. It is important to note that paralegals are restricted in the types of benefits they can dispute before the LAT. Lawyers are able to represent clients in a wider range of case situations, specifically disputes involving the determination of catastrophic impairment.

If you have suffered serious injuries, it is especially important to hire an experienced lawyer who can effectively argue your case before the LAT. At Roger R. Foisy & Associates, we have worked extensively with the LAT and are confident in our lawyers’ ability to achieve the maximum compensation for our clients.

Why should I use a lawyer when I appear before the LAT?

The best choice for your advocate is one who understands the LAT and can represent you no matter your situation.

For effective advocacy before the LAT, you should strongly consider using a lawyer with experience and a thorough understanding of the regulatory framework and behaviours during an appeal. Your lawyer should have experience appearing before the LAT, including the completion of oral hearings. An experienced lawyer will have examined and cross-examined lay witnesses, treating witnesses and expert witnesses.

More importantly, an experienced lawyer will be able to guide you through the process where the opportunity of a fair and reasonable settlement can be achieved. However, if an insurance company is unwilling to settle, an experienced lawyer will be able to properly represent you at the LAT hearing.

Additional Costs

Depending on the type of appeal you are advancing, your case may also require additional costs.

If you are appearing before the LAT for complex issues like income replacement benefits, attendant care benefits, or the determination of catastrophic impairment, you will need expert witnesses to provide the information you need to win your case.

Experts require payment for their reports as well as their testimony if they are to appear as an expert on your behalf at an oral hearing at the LAT. Some law firms including ours will advance the costs associated with hiring expert witnesses for your case, which can vary between $25,000-$35,000.

In these situations, your law firm requires the financial means to handle the expenses of third-party medical reports and expert testimony.

It is important to understand that the law firm you hire is prepared to fund these expenses in the event you are required to appeal your insurance company’s denial of your accident benefits.

If you or someone you love has been denied benefits by your automobile insurance provider, we encourage you to contact us for a free consultation. Roger R. Foisy & Associates is a team with extensive experience in handling complex personal injury and long-term disability cases, and are lawyers for the people who fight to receive maximum dollars for their clients.

Roger R. Foisy, Harpreet S. Sidhu, and Daniel Berman are Ontario Personal Injury Lawyers with extensive experience in motor vehicle accident cases. They are strongly supported by Rusald Laloshi, a senior paralegal who has also represented many clients before the LAT. If you have been injured in a motor vehicle accident, please get in touch with us for immediate support and a free consultation.

Merry Christmas & Happy New Year!

The team at Roger R. Foisy & Associates would like to wish you and your loved ones a Merry Christmas and a Happy New Year! We hope your holiday season is filled with good company, good food, and plenty of relaxation. May you take this time to reflect on the year and look forward to what 2023 brings.

The team at Roger R. Foisy & Associates would like to wish you and your loved ones a Merry Christmas and a Happy New Year! We hope your holiday season is filled with good company, good food, and plenty of relaxation. May you take this time to reflect on the year and look forward to what 2023 brings.

As we look ahead, our team remains committed to providing every client with personalized attention and quality service, as well as working our hardest to ensure clients receive maximized disability and personal injury settlements.

Holiday Hours

December 23: Open

December 24-27: Closed

December 28-30: Open

December 31-January 2: Closed

January 3: Open

A Holiday Season for Giving

Our firm has an annual practice of giving during the holiday season; this year, our staff members will be donating money to go towards purchasing gas and grocery gift cards to be given to the less fortunate. Our firm will be matching all donations made by our team.

Team members will also be designing and making holiday cards, which will be sent with these gift cards to individuals in need.

Season’s Greetings from Roger R. Foisy & Associates to you and your loved ones!

Roger R. Foisy to Speak at CSME Webinar

Roger R. Foisy has been invited to speak at an upcoming webinar for the Canadian Society of Medical Evaluators (CSME) this December 1st, 2022. The webinar will discuss Tips and Strategies when Testifying for Occupational Therapy and Functional Abilities Evaluations.

This webinar will identify to occupational therapists and other medical evaluators how to provide information clearly and objectively when testifying at trial to ensure that you appear credible and make sure the trier of fact will consider your testimony.

Information will focus on functional and in-home evaluations and be relevant to all disciplines when testifying.

Roger will be joined as a presenter at this seminar by Louis Zavodni, clinical director and owner of Total Healthcare Solutions, and Stacey Baboulas, occupational therapist and owner of Stacey Baboulas & Associates. This webinar will be moderated by Dr. Rhonda Nemeth, Ph.D., C. Psych., CMLE (O), C-CAT (MB) of the CSME.

The CSME is the leading national organization of professionals involved in independent medicolegal and clinicolegal evaluations using evidence-based medicine and best clinical practices.

For more information or to register for this webinar, please visit the CSME website. Registration is available for both members and non-members of the CSME.

Roger R. Foisy, Harpreet S. Sidhu, and Daniel Berman are experienced Ontario Personal Injury Lawyers with extensive experience in motor vehicle accident cases. If you have been injured in a motor vehicle accident, please get in touch with us for immediate support and a free consultation.

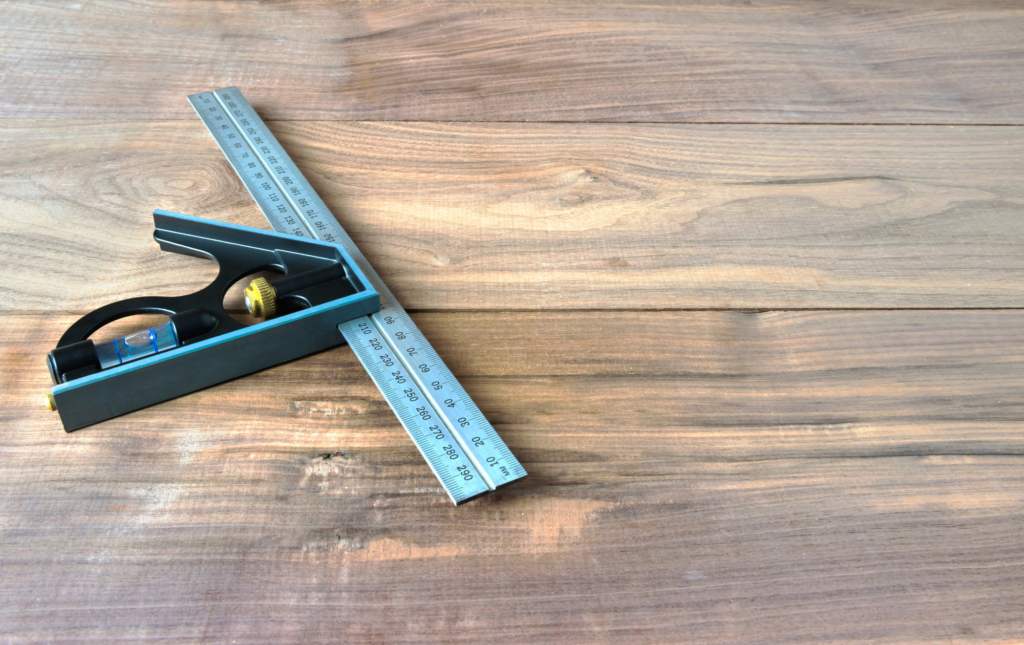

Always bring a combination square with you! The importance of proper tools while using municipal sidewalks

Trips, slips, and falls are common sources of litigation for municipalities. Ensuring that sidewalks are in a state of good repair and are not impacted by poor weather conditions or damage is part of the regular maintenance that must be completed.

If you have been injured from a slip, trip, and fall due to ice or snow in Ontario, you must act quickly to provide written notice. You have only ten days to provide written notice to municipalities if the fall occurred on a municipal sidewalk or roadway, and only 60 days to provide written notice to the property owner or responsible maintenance contractor for all other properties. For more information about this, please read our blog discussing this policy.

To help protect yourself, it is important to follow certain practices: wear boots in the winter and running shoes if you are out for a run. But what about carrying professional measuring tools?

We wish to raise awareness of a recent court decision, in the case of Cromarty vs Waterloo (City). In this case, the plaintiff fell on the municipal sidewalk that she regularly travels. Two weeks later, the plaintiff and her son-in-law returned to the location to re-examine the area.

They took photographs of the location and measured the height difference between the two sidewalk slabs where she fell. The measurements were taken with a makeshift tool, composed of a piece of cardboard and a ruler. With their tool they found that the difference between the blocks was 20-25 mm.

Two separate investigators were assigned to determine the height difference in this case, who utilized a combination square to determine the difference in sidewalk block heights. These investigators determined that the difference was closer to 17.5-18.5 mm – a difference of 1.5-6.5 mm from the plaintiff’s tool.

It was determined by the court that using a makeshift measurement is an inaccurate way to determine a state of disrepair.

Justice Broad noted that “a ruler used alone is an inferior device to a combination square for the purpose of measuring height differentials between two horizontal planes.” It was instead suggested that taking measurements with a combination square is the appropriate and reliable method to measure surface discontinuity.

With these results, we thought it would be important to recommend and suggest that you purchase a combination square to carry for personal use in case you fall and need to measure the surface discontinuity where you took a tumble, without delay.

Remember, only with the use of a combination square can we protect ourselves from inaccurate measurements.

Roger R. Foisy, Harpreet S. Sidhu, and Daniel Berman are experienced Ontario Personal Injury Lawyers with extensive experience in motor vehicle accidents, trips, slips, and falls, and long-term disability cases. If you have been injured in a motor vehicle accident, trip, slip, or fall, and/or your long-term disability benefits are terminated, please get in touch with us for immediate support and a free consultation.

Roger R. Foisy Invited as Speaker at 2022 OTLA Fall Conference

Roger R. Foisy has been invited to participate as a speaker at the Ontario Trial Lawyers Association (OTLA) 2022 Fall Conference. The conference theme this year is The Pressures of Practice.

Roger will be participating in a presentation discussing the topic of “An In-depth Analysis of Why the Plaintiff Bar is Shouldering the Out of Hand Cost for Disbursements”. Roger is regularly invited to speak at OTLA and other organizations on topics relating to Practice Management, Personal Injury, and Long-Term Disability.

The event is scheduled for October 28, 2022, is exclusive to OTLA members. To register, please visit the OTLA website.

The OTLA is a non-profit professional association for plaintiff lawyers and staff with over 1400 members across Ontario, other provinces, and the US. By offering training, enhancing access to justice, promoting and advocating for full and just protection, and offering practical solutions to improve the legal system, the OTLA works to advocate for the rights of those who have suffered injury and loss due to the wrongdoing of others.

Roger R. Foisy, Harpreet S. Sidhu, and Daniel Berman are experienced Ontario Personal Injury Lawyers with extensive experience in motor vehicle accident cases. If you have been injured in a motor vehicle accident, please get in touch with us for immediate support and a free consultation.

World Mental Health Day: Recognizing the Psychological Fallout of Motor Vehicle Accidents

World Mental Health Day is an international day for mental health education, awareness, and advocacy, celebrated on October 10th each year. Originally created in 1992, this day helps raise awareness and bring attention to mental illness and its effects on people’s lives worldwide.

While we often recognize that psychological disorders can be pre-existing or caused by stress, many don’t consider the impact that motor vehicle accidents can have on a person’s mental health. Motor vehicle accidents are typically thought of as causing physical injury and damage to the person. However, psychological conditions can arise after an accident — even if it is not serious.

In a 2021 study completed it was found that survivors of motor vehicle accidents reported substantial rates of mental health problems, with 32.3% suffering from post-traumatic stress disorder (PTSD), 17.4% suffering from depression, and 5.8% suffering from anxiety.

It is important to recognize that motor vehicle accidents can cause physical, cognitive, and psychological damages, for which victims can be entitled to coverage.

The Psychological Fallout of Motor Vehicle Accidents

As a personal injury law firm, we see the devastating impact that motor vehicle accidents can have on individuals and their families. We understand how important it is for victims to be able to recover from their injuries, whether physical or mental.

Unfortunately, there is still a stigma around those who suffer from mental health issues like PTSD. This can prevent people from coming forward after an accident and seeking help.

It is time to change this. We need to raise awareness about PTSD, depression, and other ailments and how they can affect people who are involved in motor vehicle accidents. We want our clients to know that they are not alone and that we are here for them every step of the way.

Can you claim psychological damages after a car accident?

Sometimes, a motor vehicle injury can lead to a severe psychological illness. If your condition is causing you to be unable to work or carry out housework, you can claim monetary losses for your psychological damages. Non-monetary losses can also be claimed, such as difficulty interacting with others, a distraction from enjoying life, and other symptoms.

Roger R. Foisy and Associates understand the challenges facing individuals who experience these types of disabilities. We take a special approach to handling psychological or psychiatric disability cases.

Settling Mental Health Claims

Every legal case has its own circumstances and with that, individual considerations. Determining whether one should settle their claim requires the understanding of an entire case to give accurate insight.

Settling motor vehicle accident benefits for an amount of money which usually is within the $65,000 maximum when it comes to medical, rehab, and attendant care benefits may prove to be problematic if over time your injuries worsen and can still be traced back to their original cause.

It is important to remember that as a person’s physical or cognitive injuries fail to improve and become chronic, their mental and behavioural state can also become debilitating.

Suppose that condition on its own results in an accident victim becoming markedly impaired in three of four areas (activities of daily living, social functioning, concentration, persistence and pace or adaptation), or extremely impaired in one of the same four areas. In that case, that person could later be deemed catastrophically impaired.

The law also recognizes a combination of physical, cognitive, and mental behavioural whole person impairment of at least 55% (with 53% rounding up to 55%) resulting in a person being deemed catastrophically impaired.

For more information on catastrophic injury coverage, read our blog regarding optional benefits and how they can protect you in case of a motor vehicle accident.

If you or someone you know has been involved in a motor vehicle accident, contact a personal injury lawyer immediately. A lawyer can help you assess the situation and make decisions about filing a claim against the person responsible for the accident.

Roger R. Foisy, Harpreet S. Sidhu, and Daniel Berman are experienced Ontario Personal Injury Lawyers with extensive experience in motor vehicle accident cases. If you have been injured in a motor vehicle accident, please get in touch with us for immediate support and a free consultation.

Using Structured Settlement to Help Those Who Suffer From Traumatic Brain Injuries

People who suffer from traumatic brain injury, or TBI, face a different world than the everyday person. A person who has a TBI is more likely to suffer from mental health issues and is also more likely to experience unemployment, homelessness, and in some cases incarceration.

People who suffer from traumatic brain injury, or TBI, face a different world than the everyday person. A person who has a TBI is more likely to suffer from mental health issues and is also more likely to experience unemployment, homelessness, and in some cases incarceration.

TBI is a traumatic experience – those who suffer are forced to change their lives dramatically to find a new quality of life and adjust to their new reality, which can be a struggle. Where they once were able to complete simple tasks on their own, they may have to rely on others, and often lose a sense of independence in their life.

In Canada, when negotiating a settlement for a person who has suffered a brain injury, a structured settlement is often used to provide more benefits for the plaintiff. Structured settlements can offer a better quality of life and make it easier to manage financial stability for the recipient.

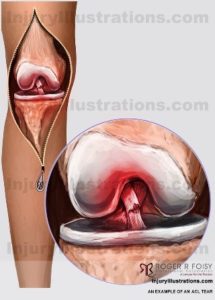

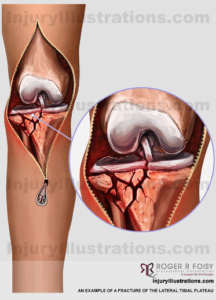

What is a traumatic brain injury?

A traumatic brain injury, or TBI, is a form of brain injury that occurs when a sudden trauma causes damage to the brain.

Traumas that may cause a TBI include hitting one’s head on a hard surface after a trip or fall or a motor vehicle collision where the head is struck on the interior of the car, or by force of a deploying air bag. However, it is imperative to note that a direct impact to the head is not required for a TBI to occur. Rather, a simple whiplash motion (e.g. from a rear-end collision), can cause a TBI as well.

Traumatic brain injuries cause many challenges, including issues with muscle coordination, memory, emotional control, dizziness, fatigue, headaches, ringing in the ears, reduced focus and concentration, and paralysis. For more information, please read our blog discussing the symptoms and effects of a TBI.

What is a structured settlement?