Long-Term Disability Claims

One of the most vulnerable moments for disabled persons is being denied a rightful long-term disability claim by their insurance company. Being medically incapable of working due to a physical or psychological illness or injury and receiving adversarial treatment from an insurer can also have a deteriorating effect on your well-being and recovery.

If you’ve been denied a long-term disability claim, not all hope is lost. Our team of long-term disability lawyers is here to help you get the benefits you deserve.

Initial Consultations Are Always With A Lawyer

Long-Term Disability Claims with an Experienced Legal Team

If you cannot work due to a medical condition such as an injury or illness, having disability insurance can be beneficial, as it can offer some financial security in a time of uncertainty and hardship for you and your family. Long-term disability benefits are a form of income supplementation; these payments can help cover daily living costs, such as bills, and can be used for expenses relating to your medical treatment and rehabilitation.

If you have been denied a long-term disability claim by your insurance provider, you need the assistance of an experienced long-term disability lawyer. Foisy & Associates is here to help.

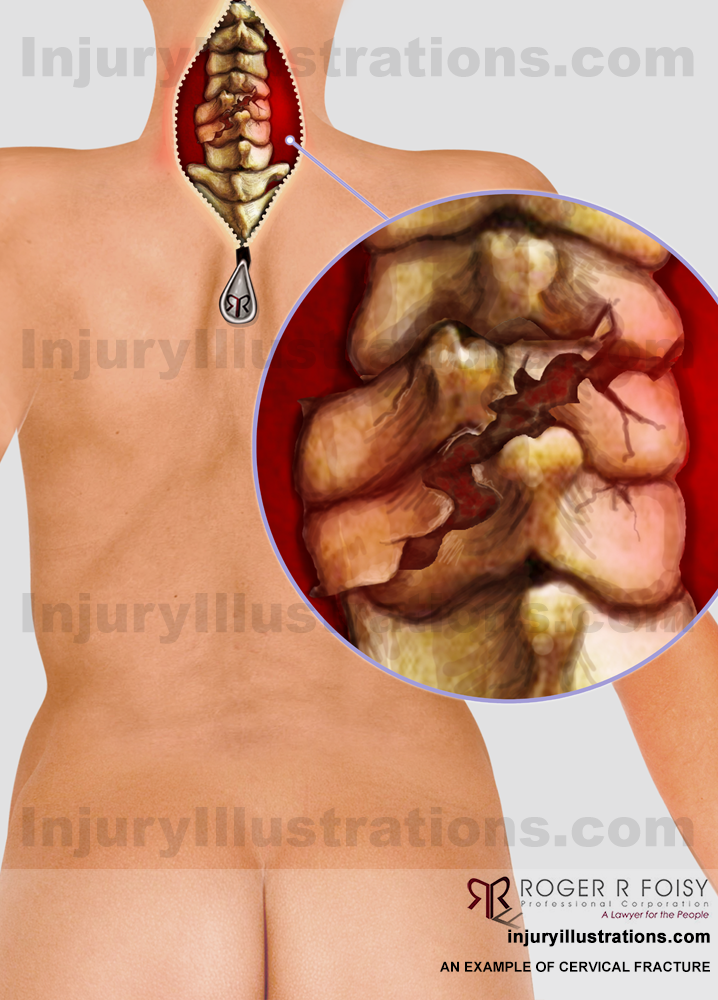

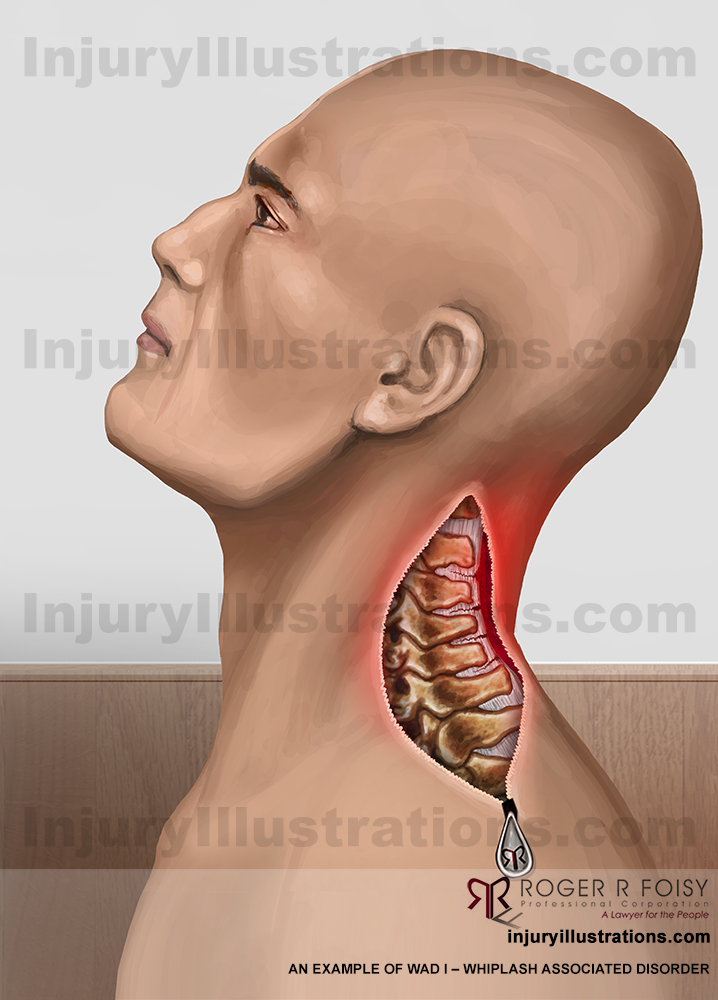

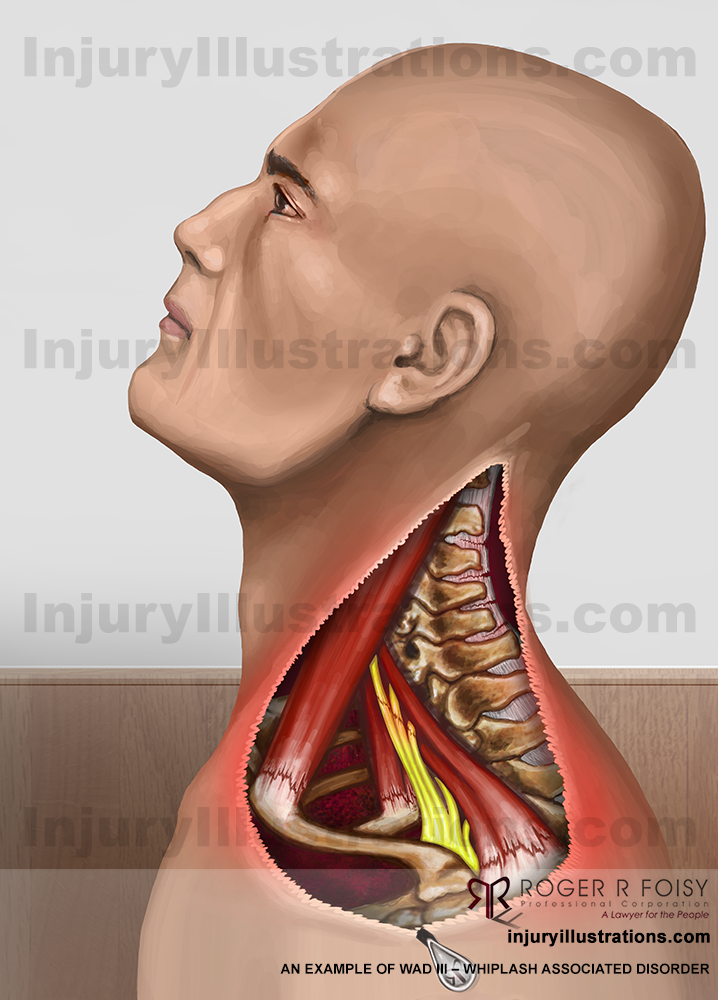

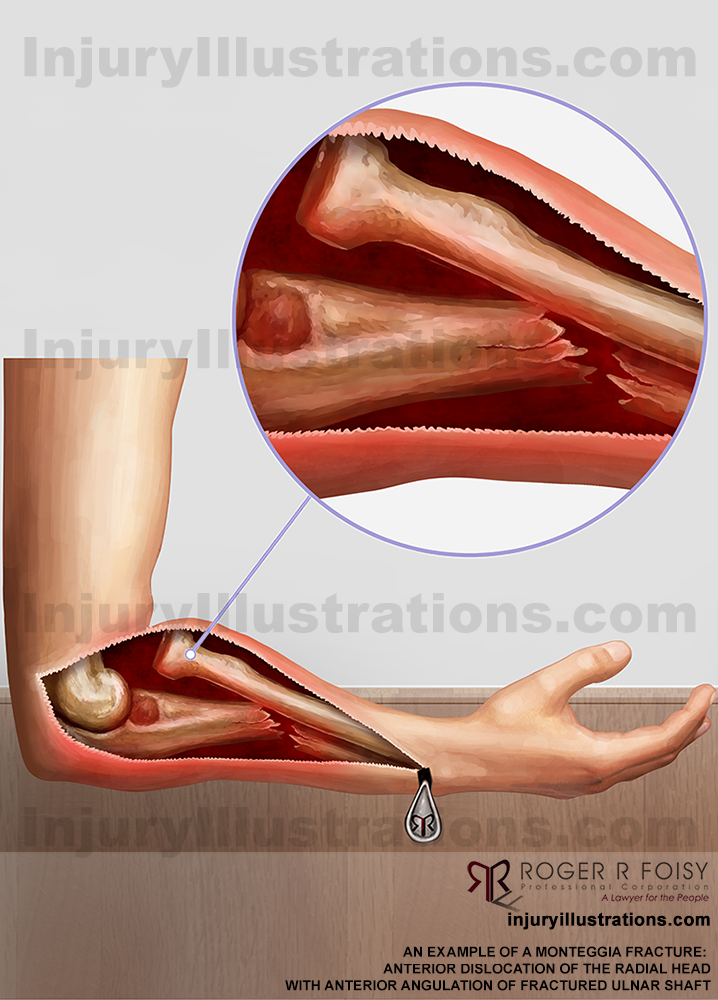

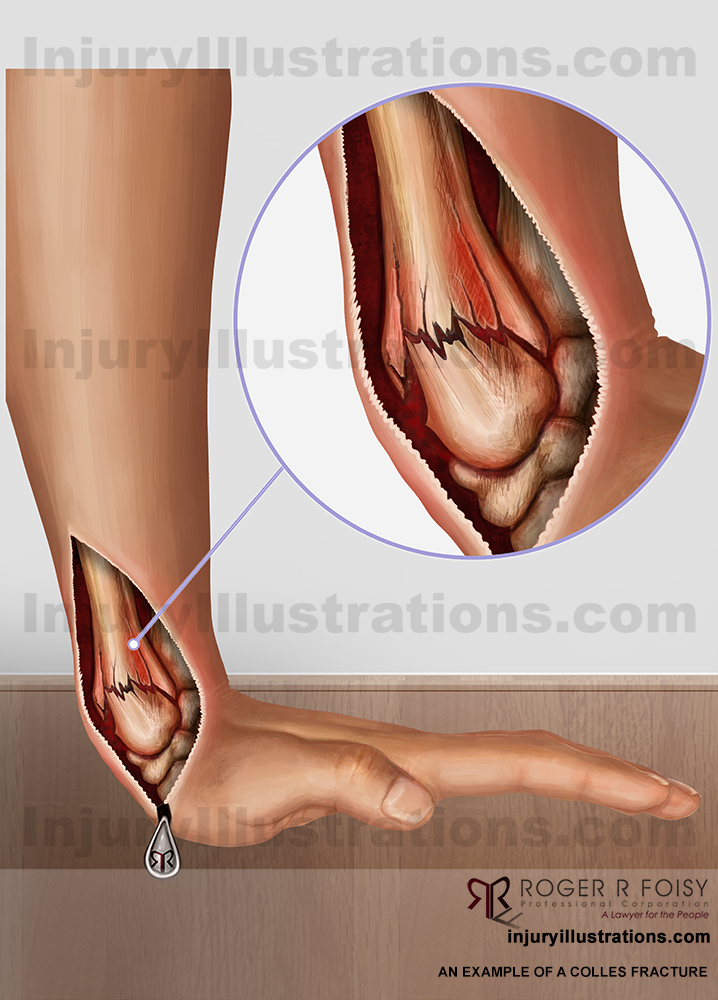

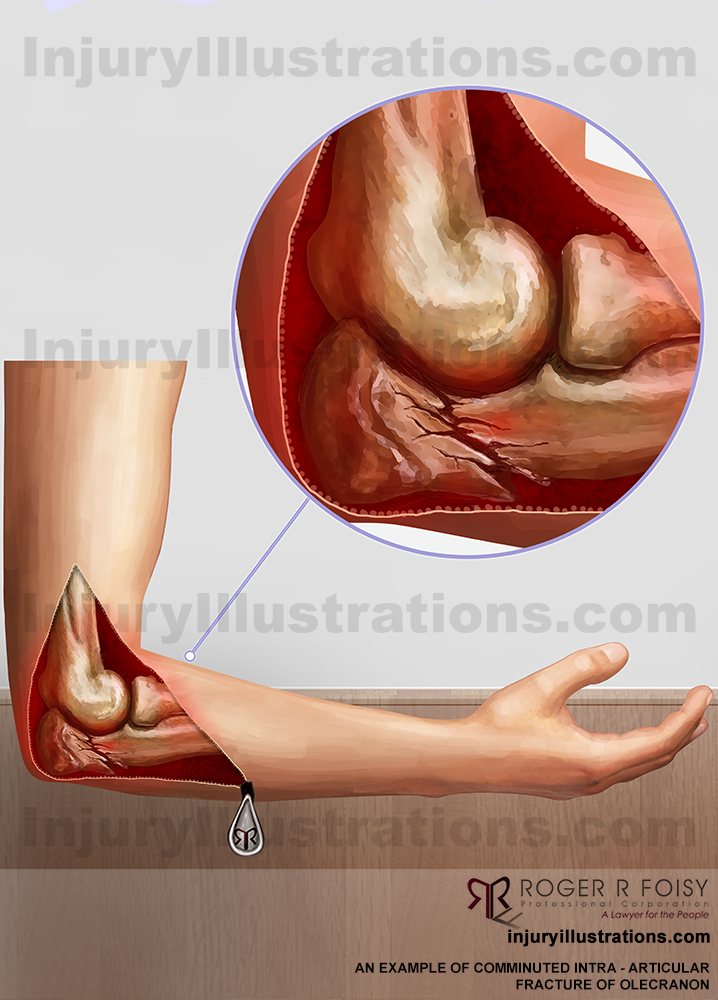

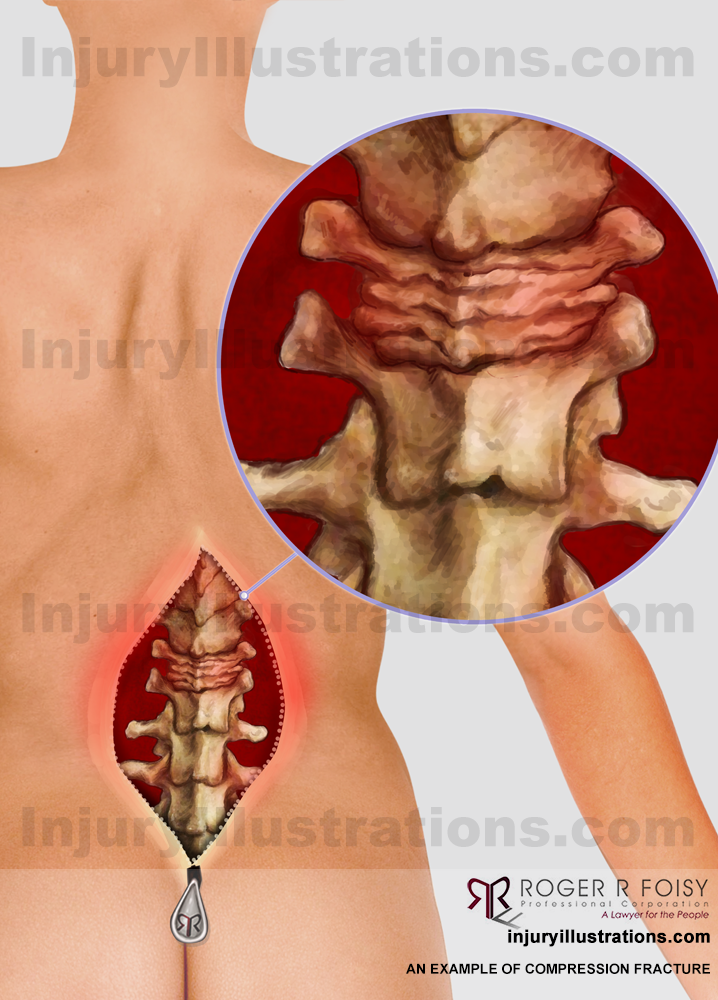

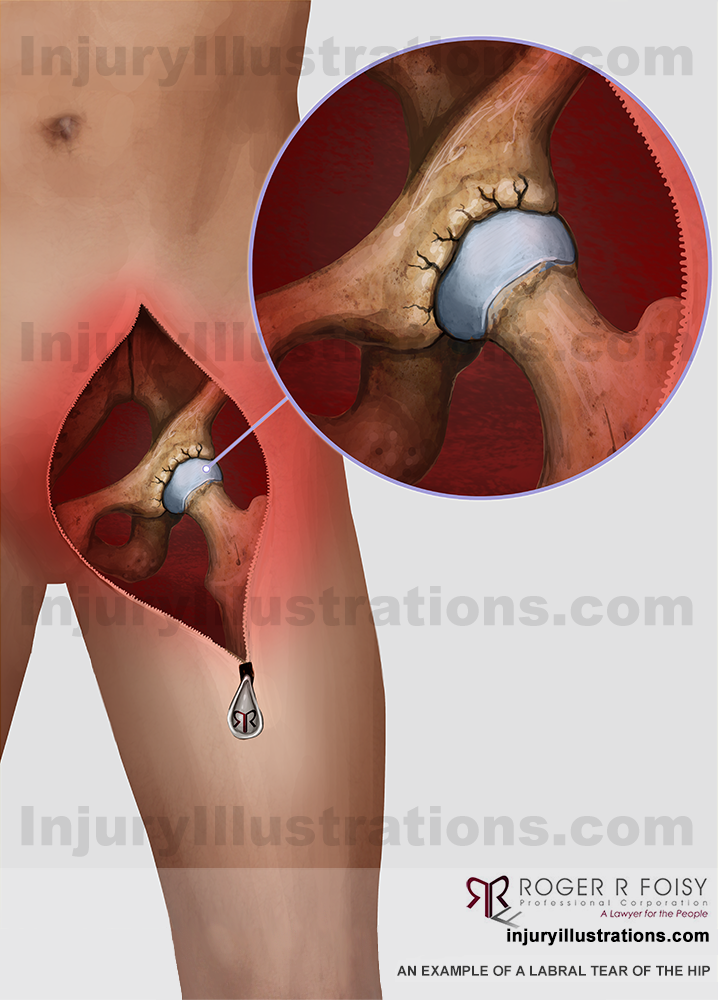

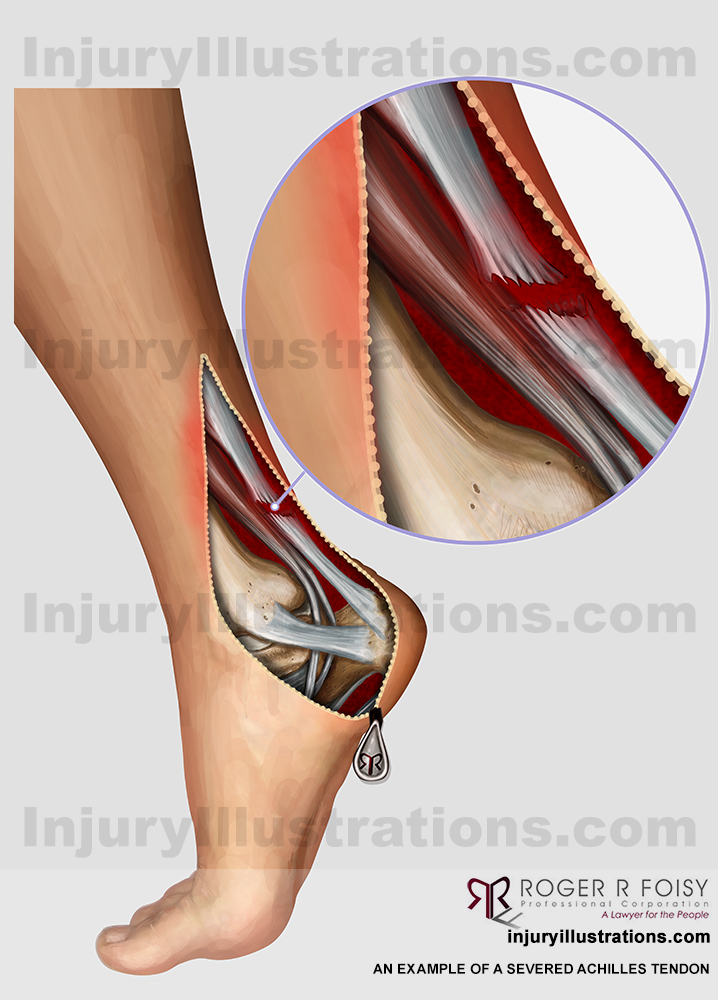

Has a serious injury changed your life forever?

Work with a Personal Injury and Disability Firm that Provides Legal Expertise

Our team offers a compassionate, caring approach to each of our cases. There’s no need to feel like a claim number; you’re a person and deserve to be treated as one.

Work with a personal injury firm that provides legal expertise and the attention to detail you deserve.

Why trust us with your long-term disability claim case?

To get the benefits you deserve, you must seek a long-term disability lawyer with the experience and knowledge to lead you through the process and handle your claim while being sensitive to the realities of your situation.

While you may be intimidated by the prospect of managing your long-term disability claim or filing a lawsuit if your claim has been denied, Foisy & Associates is committed to ensuring that you receive the benefits you are entitled to and that your peace of mind is restored.

Frequently Asked Questions About Long-Term Disability Claims

What is long-term disability insurance?

In the event of an injury or illness where you cannot return to work, long-term disability insurance offers some protection by providing you with a portion of your income that can go towards bills, expenses, and medical treatment and/or rehabilitation. Essentially, it aims to offset any financial hardship you might suffer due to being unable to return to work due to a medical condition.

Most policies provide benefits for the first two years if you are unable to meet the requirements for performing your “own occupation.” However, after two years, you must be unable to perform the tasks required by any occupation for which you are reasonably qualified by education, training, or experience to retain long-term disability benefits.

Watch this video to learn more about long-term disability insurance in Ontario (View all LTD videos):

What is the difference between short term disability insurance and long-term disability insurance?

Short term disability insurance can provide you with replacement wages if you are temporarily unable to work. Long-term disability insurance provides more permanent income replacement as your medical condition prevents you from working longer. Note that disability benefits are different from workplace insurance benefits as disability benefits arise from an illness or injury that is not required to occur on the job. In contrast, workplace compensation benefits are awarded due to being in the course of your employment.

What is the difference between individual disability insurance and group disability insurance?

Businesses purchase Group Disability Insurance and provide disability coverage to employees who are temporarily and/or completely or totally disabled and, therefore, unable to work due to a medical condition. If in a group plan, you may pay the premiums through your paychecks, or your employer may pay all or part of the premiums. Ask your employer if you are covered under such a policy.

Related Insights

Videos About Long Term Disability Claims

TALK TO A LAWYER

Request a FREE Consultation

This can be a difficult time, with many uncertainties regarding potential claims. We’ll spend as much time as needed to understand you and your unique situation.

To start your free consultation, simply fill out this form or call us at (905) 286-0050.

Explore our Injury Resources

Explore Potential Settlement Values for Common Injuries

Use our interactive chart to explore potential settlement values for various injuries.

Testimonials