Catastrophic Injury

Experiencing a catastrophic injury can be a devastating and overwhelming event, whether it’s you or a loved one involved. At Foisy & Associates, we approach every case with expertise and compassion for your situation. Whether you’ve experienced a traumatic brain injury, spinal cord injury, or any other impairment, our team of catastrophic accident lawyers will work tirelessly to secure you the benefits and compensation you deserve.

Initial Consultations Are Always With A Lawyer

Foisy & Associates – Your Catastrophic Accident Lawyer Team

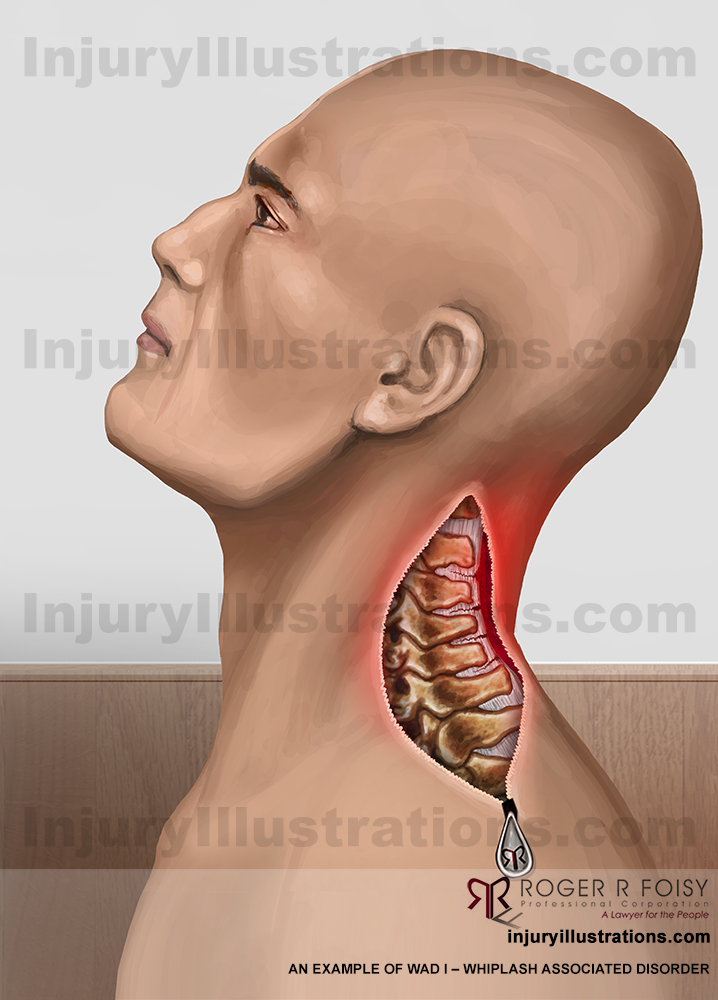

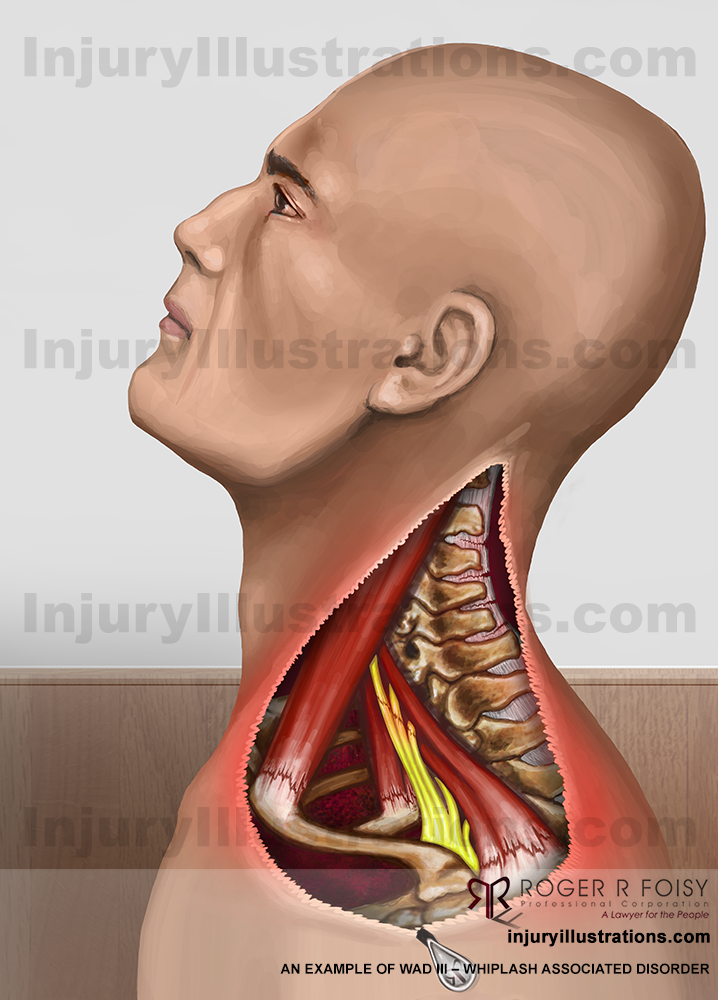

The impact can be life-changing when you have been in a car accident. Whether a visible impairment such as quadriplegia or an internal injury such as a traumatic brain injury, these catastrophic injuries impact those who suffer for the rest of their lives.

Every person injured in a motor vehicle accident has automobile insurance with different benefits depending on the options they choose within their coverage. There are different types of coverage for every level of injury – minor injuries, non-minor injuries, and catastrophic injuries. Your insurance provider will determine which of these apply to your injury.

Has a serious injury changed your life forever?

You don’t have to go through this alone.

Our team offers a compassionate, caring approach to each of our cases. There’s no need to feel like a claim number; you’re a person and deserve to be treated as one.

Work with a personal injury firm that provides legal expertise and the attention to detail you deserve.

Why trust us with your catastrophic injury case?

Your insurance company usually makes a catastrophic impairment determination at the recommendation of medical professionals. With multiple ways to define catastrophic impairment, insurance companies may deny your claim if they do not believe your impairment is catastrophic.

This scenario can be devastating for an individual, but do not lose hope. You can appeal your insurance provider’s decision with an expert personal injury lawyer. An experienced catastrophic accident lawyer will not only be able to help achieve catastrophic determination but also negotiate appropriate compensation for injuries thanks to their knowledge and understanding of an individual’s future recovery needs, costs, and risks.

No matter the situation at hand, our team is here to help. We have extensive experience in handling complex catastrophic injury cases and fight to receive maximum dollars for our clients. We are lawyers for the people.

If you have suffered an injury and your insurance company is denying you access to catastrophic injury benefits, you need lawyers who are willing to stand up for you and advocate on your behalf. Whether your case is settled independently or goes to court or tribunal, having an experienced legal team by your side can help ensure you get the benefits you are entitled to.

Contact us if you have any questions about catastrophic injury or for a free consultation.

Frequently Asked Questions About Catastrophic Impairment

What is a Catastrophic Impairment?

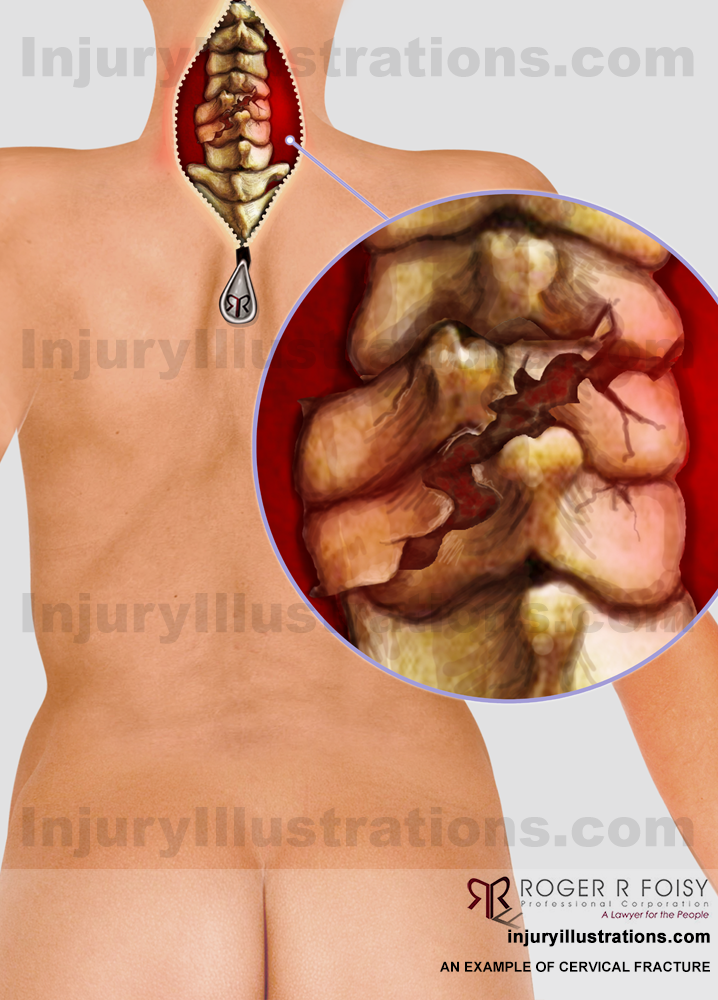

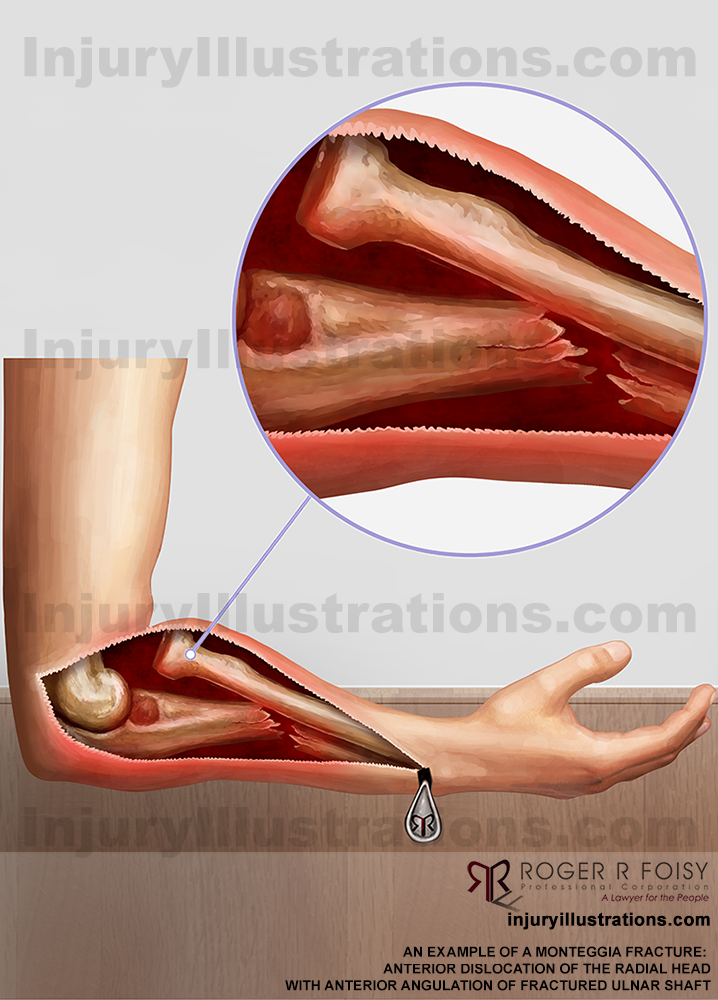

“Catastrophic impairment,” is a legal definition constructed by legislation governing accident benefits claims. Some injuries, if sustained as a result of a motor vehicle accident, enable a person to obtain an automatic classification of catastrophic impairment, including quadriplegia, total loss of vision (blindness) in both eyes, paraplegia, and complete loss of use of upper or lower extremities.

Some injuries are not so “obvious” as to warrant an automatic catastrophic impairment designation under the legislation. One example is a traumatic brain injury, which could support the finding of catastrophic impairment in certain cases. Other examples generally involve multiple separate injuries and their combined effects, calculated using strict methods in evaluating impairments, relying on the American Medical Association’s Guides to the Evaluation of Permanent Impairment (AMA Guides), 4th and 6th Editions.

If your injuries are rendered “catastrophic” (often abbreviated as “CAT”), a standard automobile policy includes the following catastrophic impairment benefits at no extra cost:

- Medical, rehabilitation, and attendant care benefits are available up to $1,000,000.00, without any time limits. The monthly attendant care benefit available is also doubled, with up to $6,000.00 available to catastrophically injured individuals needing assistance with their care.

- Housekeeping and home maintenance benefits at $100.00/week.

In addition to receiving access to these benefits, injured persons can also access higher hourly rates of healthcare professionals for reimbursement of their medical and rehabilitation expenses. These rates are prescribed under the Professional Services Guidelines, which can be up to 40% higher for catastrophically injured claimants. This means a person who is catastrophically injured will be able to receive more toward their therapists’ hourly rates than those who are not.

What is a Catastrophic Injury Under Ontario Law?

Many factors may play a part in what qualifies as a catastrophic injury for each individual. One of the main factors that must be considered is the law that was in effect on the date of your injury. In June 2016, the provincial government changed some of the criteria for catastrophic injuries, so it is essential to understand that injuries before June 2016 and after June 2016 will be determined through different rules. Some of the impairments remained the same, while others were changed.

The current (post-June 2016) legislation (the Statutory Accident Benefits Schedule) describes the following injuries as “catastrophic impairments”:

Paraplegia or tetraplegia that meets the following criteria:

- The insured person’s neurological recovery is such that the person’s permanent grade on the ASIA Impairment Scale can be determined.

- The insured person’s permanent grade on the ASIA Impairment Scale is or will be,

- A, B or C, or

- D, and

- the insured person’s score on the Spinal Cord Independence Measure is 0 to 5,

- the insured person requires urological surgical diversion, an implanted device, or intermittent or constant catheterization to manage a residual neurological impairment, or

- the insured person has impaired voluntary control over anorectal function that requires a bowel routine, a surgical diversion, or an implanted device.

- Severe impairment of ambulatory mobility or use of an arm, or amputation that meets one of the following criteria:

- Trans-tibial or higher amputation of a leg.

- Amputation of an arm or another impairment causing the total and permanent loss of use of an arm.

- Severe and permanent alteration of prior structure and function involving one or both legs as a result of which the insured person’s score on the Spinal Cord Independence Measure is 0 to 5.

- Loss of vision in both eyes that meets the following criteria:

- Even with the use of corrective lenses or medication,

- visual acuity in both eyes is 20/200 (6/60) or less as measured by the Snellen Chart or an equivalent chart, or

- the greatest diameter of the field of vision in both eyes is 20 degrees or less.

- The loss of vision is not attributable to non-organic causes.

- Even with the use of corrective lenses or medication,

- If the insured person was 18 years of age or older at the time of the accident, a traumatic brain injury that meets the following criteria:

- The injury shows positive findings on a computerized axial tomography scan, magnetic resonance imaging, or any other medically recognized brain diagnostic technology indicating intracranial pathology that is a result of the accident, including but not limited to, intracranial contusions or haemorrhages, diffuse axonal injury, cerebral edema, midline shift or pneumocephaly.

- When assessed in accordance with the Glasgow Outcome Scale, and the Extended Glasgow Outcome Scale the injury results in a rating of,

- Vegetative State (VS or VS*), one month or more after the accident,

- Upper Severe Disability (Upper SD or Upper SD*) or Lower Severe Disability (Lower SD or Lower SD*), six months or more after the accident, or

- Lower Moderate Disability (Lower MD or Lower MD*), one year or more after the accident.

- If the insured person was under 18 years of age at the time of the accident, a traumatic brain injury that meets one of the following criteria:

- The insured person is accepted for admission, on an in-patient basis, to a public hospital named in a Guideline with positive findings on a computerized axial tomography scan, a magnetic resonance imaging, or any other medically recognized brain diagnostic technology indicating intracranial pathology that is a result of the accident, including, but not limited to, intracranial contusions or haemorrhages, diffuse axonal injury, cerebral edema, midline shift, or pneumocephaly.

- The insured person is accepted for admission, on an in-patient basis, to a program of neurological rehabilitation in a paediatric rehabilitation facility that is a member of the Ontario Association of Children’s Rehabilitation Services.

- One month or more after the accident, the insured person’s level of neurological function does not exceed category 2 (Vegetative) on the King’s Outcome Scale for Childhood Head Injury.

- Six months or more after the accident, the insured person’s level of neurological function does not exceed category 3 (Severe disability) on the King’s Outcome Scale for Childhood Head Injury.

- Nine months or more after the accident, the insured person’s level of function remains seriously impaired such that the insured person is not age-appropriately independent and requires in-person supervision or assistance for physical, cognitive, or behavioural impairments for the majority of the insured person’s waking day.

- A physical impairment or combination of physical impairments that, in accordance with the American Medical Association’s Guides to the Evaluation of Permanent Impairment, results in 55 percent or more physical impairment of the whole person.

- A mental or behavioural impairment, excluding traumatic brain injury, determined in accordance with the rating methodology in the American Medical Association’s Guides to the Evaluation of Permanent Impairment, that, when the impairment score is combined with a physical impairment and combining requirements in the guide, results in 55 percent or more impairment of the whole person.

An impairment that, in accordance with the American Medical Association’s Guides to the Evaluation of Permanent Impairment, results in a class 4 impairment (marked impairment) in three or more areas of function that precludes useful functioning or a class 5 impairment (extreme impairment) in one or more areas of function that precludes useful functioning, due to mental or behavioural disorder.

What is the Significance of a “Catastrophic” Impairment?

Every person injured in a motor vehicle accident has access to a certain amount of benefits, depending on the options they decide to purchase with their insurance. These benefits are divided into three tiers, which each injured person may fall under depending on their level of injury. The three tiers are minor injuries, non-minor/non-catastrophic injuries, and catastrophic injuries.

Some benefits are included with each standard auto insurance policy, and optional coverage is available to anyone who wishes to purchase increases to the benefits they may have available in the event of an unfortunate injury.

The standard auto insurance policy includes the following benefits:

- Income Replacement Benefits (up to $400/week weekly maximum included)

- Non-Earner benefit (weekly maximum of $185/week, up to 2 years)

- Medical and Rehabilitation and Attendant Care Benefits (5-year time-limit included. Minor Injury claims are limited to $3,500 over the entire claim, without a right to attendant care benefits. Non-minor injuries entitle a person to a maximum claim limit of $65,000.00, including access to the Attendant Care Benefits of no more than $3,000.00/month)

- Lost Educational Expenses ($15,000.00 limit)

- Death and Funeral benefits ($25,000.00 to the surviving spouse, $10,000.00 to each surviving dependant, $6,000.00 limit for funeral expenses)

Related Insights

Videos About Catastrophic Injury

TALK TO A LAWYER

Request a FREE Consultation

This can be a difficult time, with many uncertainties regarding potential claims. We’ll spend as much time as needed to understand you and your unique situation.

To start your free consultation, simply fill out this form or call us at (905) 286-0050.

Explore our Injury Resources

Explore Potential Settlement Values for Common Injuries

Use our interactive chart to explore potential settlement values for various injuries.

Testimonials